The Red and the Black*

A daily market update from Fundstrat — what you need to know ahead of opening bell

“After moral poisoning, one requires physical remedies and a bottle of champagne.” ― Stendhal, The Red and the Black

First news

- Amazon is going to have to do its own robotic cleaning after all

- Reddit, known for turbulent, lively discussion rooms, ready to dip its toes into uncertain IPO waters

- Ari Emanuel’s TKO endangered by former WWE stalwart Ed McMahon’s stubbornly uncorporate-like reputation.

Overnight

- Live news: Hong Kong Leader Reveals Details of New National Security Law. link

- China’s 10-year Bond Yield Falls To Lowest Level Since 2002. link

- North Korea Fires Third Cruise Missile Salvo in Past Week. link

- Woman Accused of Laundering Bitcoin Proceeds of £5bn Fraud in London Trial. link

- HSBC Faces £57 Million Fine from U.K. for Mismarking Deposits. link

- Eurozone Economy Unexpectedly Stagnates in 4Q; Est. -0.1% Q/q. link

- Treasuries Higher, Curve Flatter; Bunds Lag After Euro-Zone GDP. link

MARKET LEVELS

| Overnight |

| S&P Futures -2

point(s) (-0.1%

) overnight range: -8 to +3 point(s) |

| APAC |

| Nikkei +0.11%

Topix -0.1% China SHCOMP -1.83% Hang Seng -2.32% Korea -0.07% Singapore +0.31% Australia +0.29% India -0.99% Taiwan -0.47% |

| Europe |

| Stoxx 50 +0.53%

Stoxx 600 +0.3% FTSE 100 +0.6% DAX +0.21% CAC 40 +0.44% Italy +0.51% IBEX +1.18% |

| FX |

| Dollar Index (DXY) -0.17%

to 103.44 EUR/USD +0.06% to 1.084 GBP/USD -0.23% to 1.268 USD/JPY -0.19% to 147.22 USD/CNY -0.02% to 7.1791 USD/CNH +0.0% to 7.1876 USD/CHF +0.14% to 0.8625 USD/CAD -0.09% to 1.3402 AUD/USD -0.11% to 0.6604 |

| Crypto |

| BTC +0.58%

to 43434.26 ETH +0.31% to 2313.55 XRP -0.71% to 0.534 Cardano +0.78% to 0.5297 Solana +2.55% to 104.28 Avalanche +1.8% to 36.72 Dogecoin -0.49% to 0.0814 Chainlink +1.14% to 15.14 |

| Commodities and Others |

| VIX -0.22%

to 13.57 WTI Crude +0.33% to 77.03 Brent Crude +0.15% to 82.52 Nat Gas -17.11% to 2.06 RBOB Gas -0.36% to 2.22 Heating Oil -0.79% to 2.811 Gold +0.17% to 2036.74 Silver -0.39% to 23.11 Copper +0.03% to 3.88 |

| US Treasuries |

| 1M -2.1bps

to 5.3484% 3M -2.4bps to 5.3344% 6M -1.8bps to 5.1884% 12M -2.2bps to 4.7318% 2Y -1.2bps to 4.3056% 5Y -1.4bps to 3.9687% 7Y -1.6bps to 4.0181% 10Y -1.9bps to 4.0547% 20Y -2.7bps to 4.3937% 30Y -2.7bps to 4.2865% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.7bps to -106.3

bps 10Y-2 Y Spread narrowed 0.5bps to -25.3 bps 30Y-10 Y Spread narrowed 0.7bps to 23.0 bps |

| Yesterday's Recap |

| SPX +0.76%

SPX Eq Wt +0.61% NASDAQ 100 +1.01% NASDAQ Comp +1.12% Russell Midcap +0.89% R2k +1.67% R1k Value +0.48% R1k Growth +1.1% R2k Value +1.3% R2k Growth +2.06% FANG+ +1.64% Semis +1.17% Software +1.99% Biotech +2.9% Regional Banks +1.67% SPX GICS1 Sorted: Cons Disc +1.37% Tech +0.97% Comm Srvcs +0.89% SPX +0.76% Healthcare +0.68% REITs +0.68% Utes +0.64% Indu +0.64% Cons Staples +0.52% Materials +0.52% Fin +0.3% Energy -0.2% |

| USD HY OaS |

| All Sectors +1.1bp

to 379bp All Sectors ex-Energy +1.1bp to 362bp Cons Disc +0.5bp to 324bp Indu -0.4bp to 285bp Tech +0.8bp to 474bp Comm Srvcs +4.9bp to 576bp Materials +2.1bp to 340bp Energy +0.7bp to 316bp Fin Snr -0.5bp to 354bp Fin Sub +1.1bp to 258bp Cons Staples +1.3bp to 309bp Healthcare -1.0bp to 470bp Utes +1.8bp to 232bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 1/30 | 10AM | Jan Conf Board Sentiment | 114.45 | 110.7 |

| 1/30 | 10AM | Dec JOLTS | 8750.0 | 8790.0 |

| 1/31 | 8:30AM | 4Q ECI QoQ | 1.0 | 1.1 |

| 1/31 | 2PM | Jan 31 FOMC Decision | 5.5 | 5.5 |

| 2/1 | 8:30AM | 4Q P Nonfarm Productivity | 2.5 | 5.2 |

| 2/1 | 8:30AM | 4Q P Unit Labor Costs | 1.25 | -1.2 |

| 2/1 | 9:45AM | Jan F S&P Manu PMI | 50.3 | 50.3 |

| 2/1 | 10AM | Jan ISM Manu PMI | 47.2 | 47.4 |

| 2/2 | 8:30AM | Jan AHE m/m | 0.3 | 0.4 |

| 2/2 | 8:30AM | Jan Unemployment Rate | 3.8 | 3.7 |

| 2/2 | 8:30AM | Jan Non-farm Payrolls | 185.0 | 216.0 |

| 2/2 | 10AM | Jan F UMich 1yr Inf Exp | n/a | 2.9 |

| 2/2 | 10AM | Jan F UMich Sentiment | 78.8 | 78.8 |

| 2/2 | 10AM | Dec F Durable Gds Orders | 0.0 | 0.0 |

| 2/5 | 9:45AM | Jan F S&P Srvcs PMI | n/a | 52.9 |

| 2/5 | 10AM | Jan ISM Srvcs PMI | 52.4 | 50.6 |

MORNING INSIGHT

Good morning!

This week will determine how high “Jan. new highs” go, as this is one of the largest event-driven catalyst weeks of the year, what with: (i) Treasury QRA; (ii) key macro including ISM and jobs; and (iii) the heaviest week of earnings.

Click HERE for more.

TECHNICAL

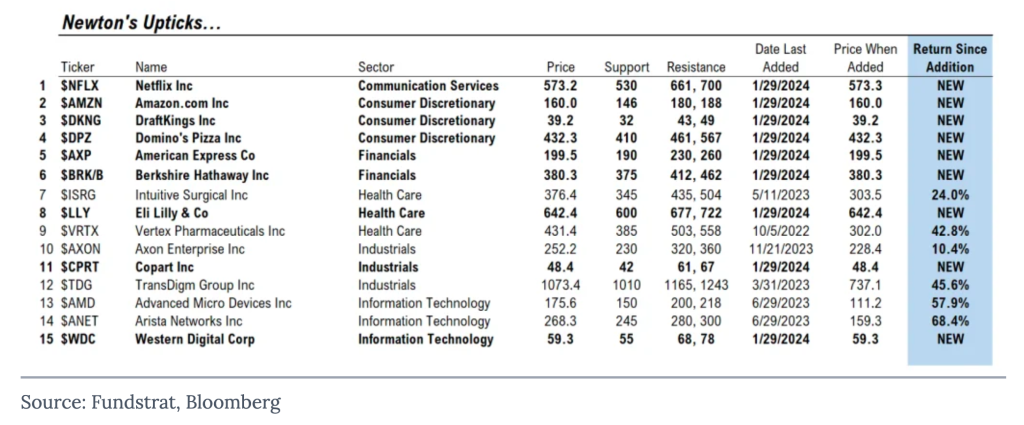

Upticks – Newton’s Law.

Nine New Additions

- NFLX-2.93% – Netflix Inc

- AMZN0.00% – Amazon.com Inc

- DKNG5.37% – DraftKings Inc

- DPZ1.39% – Domino’s Pizza Inc

- AXP2.69% – American Express Co

- BRK/B – Berkshire Hathaway Inc

- LLY0.47% – Eli Lilly & Co

- CPRT0.73% – Copart Inc

- WDC0.65% – Western Digital Corp.

Click HERE for more.

CRYPTO

ETF Outflows Subsiding.

In today’s Crypto Comments video, we discuss ETF outflows slowing, the upcoming QRA on Wednesday, and an uptick in Solana fees ahead of the Jupiter airdrop.

Click HERE for more.

FIRST NEWS

“Do the Axe-man Robot Dance!” In the future, they say robots will have feelings, what with AI-mediated complex operations coursing through their heavy-water-cooled GPU hearts. And if a story were published on a news site in the 2040s in the manner of the tabloids of the 1940s, its headline would read something like this: “Cowed by well-connected European, D.C. relations, trillionaire industrialist playboy gives hardworking cleaning-lady sweetheart the heave-ho; after year-and-a-half romance, big promises, grand plans, and billion-dollar wedding bells in the offing, insult added to injury by way of measly $94 million in hush money paid; poor lass gutted, heartbroken, on verge of breakdown.”

In today’s parlance, Amazon has axed its proposed acquisition of Roomba maker iRobot, as iRobot said it was laying off 31% of its employees and replacing its CEO. The planned 1.45 billion merger agreement, dating back to August 2022, collapsed due to opposition from European antitrust regulators as well as the FTC, whose officials told Amazon executives last week that the agency planned to sue the company to block the deal. As part of the deal termination, Amazon will pay the aforementioned go-away money to iRobot, whose shares closed down 8.8%. Axios, CNN

In completely unrelated but related-sounding news, in response to a recent deepfake impersonating President Biden and targeting thousands of New Hampshire voters, U.S. lawmakers have proposed legislation to overhaul robocall rules. CNN

Reddit, Closer to Being in the Black, Dons Rose-tinted Glasses, Colors Itself Ready. In advance of a rumored IPO, the company and its advisers are targeting a valuation “in the mid-single-digit billions,” with the ultimate figure depending on the IPO market’s nascent recovery. While trade in the volatile market for shares of private companies indicates a value for Reddit below $5 billion, the social media company has been advised to target at least a $5 billion value in a near-future IPO, possibly as soon as March – which is still roughly half the valuation at which it last raised funds.

Data from EY and Dealogic puts the number of companies that went public in the U.S. last year up by 42% over 2022, although still down 24% from 2019, as actual profits have become more of a focus for investors. With its nose to the wind, Reddit has delayed IPO plans for years to get closer to being in the black. Reuters, Bloomberg

TKO: POW, Right in the Kisser! Publicly traded companies have a fiduciary duty to their shareholders to inform them of any risks that pose existential threats to the company and/or their stakes in it. These risks typically include legal actions, changing consumer demand, and other corporate worries of the kind you’d expect to give the C-suite a Pepto Bismol habit. It’s quite extraordinary to include the company’s chairman as a risk, yet that’s exactly what TKO did recently.

In its most recent quarterly regulatory filing with the SEC, TKO, the $21 billion combat-entertainment juggernaut resulting from the merger of UFC and WWE, said that Vince McMahon, of long-time WWE fame, “could have adverse financial and operational impacts on our business,” likely on account of allegations of improper relations with colleagues. An internal investigation had revealed that McMahon had used millions in company cash as hush-money payments to cover up affairs with multiple former employees. Disgraced, he announced his retirement during the investigation, in July of 2022, but was back next year to help oversee the merger with UFC, orchestrated by Ari Emanuel, the archetypal Hollywood super-agent of Entourage fame.

Emanuel – who overcame teenage dyslexia in a Chicago suburb, double-majored in Economics and Computer Science, played professional racquetball, bohemed his way around Paris, then co-founded the Endeavor Agency in a small office above a hamburger joint in South Beverly Hills, merged it with prestigious William Morris Agency (to create intergalactically ambitious athlete-and-artist-management behemoth William Morris Endeavor, of which he is now the CEO) and had the chutzpah to propose to Elon Musk during a period of chaos at Twitter (which, come to think of it, still very much persists) that, for a fee of $100 million, Emanuel and a posse of lieutenants would run Twitter, cutting costs, patching things up with advertisers, and giving the corporate culture a much-needed overhaul (an offer which Musk’s body man Jared Birchall deemed “most insulting, demeaning, insane”, but which, given the since-going-private devaluation of Twitter by 70-pus percent, which we addressed in “Kazakhstan, greatest country in the world”, may not have been such a bad idea) – is probably having second thoughts about cavalierly discounting key-man risk while maniacally focused on creating and helming a firm of unprecedented scope and power.

Now, McMahon is again both in a TKO (i.e. technical knockout) and out of TKO (the company) – while under federal investigation. A comeback this time around looks less likely, as more former employees accusing the former WWE big of hushing them up with money keep cropping up. Plus, McMahon, who spent millions from WWE coffers to donate to the Donald J. Trump Foundation in 2007 and 2009, is no Teflon Don. Vince-McMahon risk is weighing heavily on TKO stock, which is down 13.5% over the last 5 days. FT, CNN, Deadline