About the Strategist

Thomas J. Lee, CFA – Co-Founder, Head of Research

Thomas Lee is a Managing Partner and the Head of Research at Fundstrat Global Advisors. He is an accomplished Wall Street strategist with over 25 years of experience in equity research, and has been top ranked by Institutional Investor every year since 1998. Prior to co-founding Fundstrat, he served as J.P. Morgan’s Chief Equity Strategist from 2007 to 2014, and previously as Managing Director at Salomon Smith Barney.

Our Approach

Actionable Investment Ideas

- Tailored recommendations based on macro trends

- Sector-specific actionable insights for optimal portfolio positioning

- Frequent updates ensuring timely decision-making

Global Economic Health

- Periodic assessments of global GDP growth

- Evaluations of leading and lagging economic indicators

- In-depth analysis of global trade patterns

Monetary Policies and Central Banks

- Insights into global central bank actions

- Predictive analysis of interest rate shifts

- Assessment of quantitative easing impacts

Inflation Dynamics

- Comprehensive reviews of inflationary trends

- Insights into core vs. headline inflation

- Evaluations of factors driving inflationary pressures

Interest Rates and Fixed Income Markets

- Analysis of yield curves and their implications

- Predictions on interest rate trajectories

- Insights into global bond markets

Sector Weighting

- Sectoral analysis based on macroeconomic shifts

- Recommendations on sector allocations

- Insights into emerging sector opportunities

Currency Markets

- Deep dives into major and minor currency pairs

- Analysis of geopolitical events affecting currency values

- Predictions on future currency strength and weaknesses

Commodities and Energy

- Examination of oil, gold, and other commodity price movements

- Insights into supply-demand dynamics

- Predictions based on geopolitical and environmental factors

Emerging Markets

- Comprehensive analysis of burgeoning economies

- Evaluations of risks and opportunities in specific regions

- Insights into trade dynamics affecting emerging markets

Demographics and Social Trends

- Analysis of global demographic shifts

- Insights into supply-demand dynamics

- Predictions based on geopolitical and environmental factors

Geopolitical Risks

- Comprehensive assessment of global political events

- Predictions on market reactions to geopolitical tensions

- Analysis of potential economic sanctions and their impacts

Sustainability and Climate Economics

- Examination of oil, gold, and other commodity price movements

- Insights into supply-demand dynamics

- Predictions based on geopolitical and environmental factors

Research and Coverage

Reports

First Word

Delve deep into a holistic market overview with our "First Word" reports. Scrutinize macro indicators, current trends, and sector rotations, and unravel fact-based evidence that points towards prospective market opportunities.

Prediction markets see higher oil thru June = longer conflict. But we still see March as "up month"

The US attack on Iran is now in its 10th day and since then, the S&P 500 is down -1.4%. To us, the conflict is likely longer than consensus expectations (which is a short war) and perhaps the best leading indicator is...

⚡️FlashInsights

Dive into real-time market insights with Tom Lee as he navigates through crucial market dynamics and events pivotal to macro strategy. Stay informed, stay ahead.

Thomas Lee, CFA

Head of ResearchSuper Court rules Trump tariffs are not legal. Attached are some thoughts post-Supreme Court: * The Supreme Court decision is as expected and is not a surprise, but the timing was unknown * The administration may try several paths, including: Congress puts...

Intraday Alerts

When the market takes unexpected turns, our "Intraday Alerts" come to your rescue. These short-form reports clarify significant market-moving events, ensuring you're never caught off-guard and always make informed decisions.

INTRADAY ALERT: Thoughts ahead of FOMC rate decision at 2pm ET

At 2:00pm ET today, the FOMC will make its interest rate decision for September and a press conference starting at 2:30pm ET:

Earnings

When earnings season rolls around, we've got you covered. Our comprehensive reports detail earning conditions, earning beats, and stock performance by sector, providing a clear and insightful analysis of the market's response to earnings releases.

Fundstrat 4Q25 Daily Earnings (EPS) Update – 03/12/2026

Click HERE to view the report in PDF format. * 4 companies are reporting this week. * Of the 494 companies that have reported so far (99% of the S&P 500): * Overall, 76% are beating estimates, and those that "beat" are beating...

Weekly Roadmap

End your week with our "Weekly Roadmap", a summary that encapsulates our expert views and closing remarks for the week. This digest is crafted to bring all market happenings and our insights into one coherent context, ensuring you're well-informed and ready for the week ahead.

Increased Geopolitical Conflict And Surging Oil Prices Drag Down Stocks

The S&P 500 fell 2% this week, with 10 out of the 11 sectors down. The worst performance came out of the materials and consumer-staples sector, which were down 7.2% and 4.9%, respectively. Naturally, the energy sector benefited...

Hardika Singh

Economic Strategist, Market IntelligenceMedia

Macro Minute Video

Visualize macro strategy insights with "Macro Minute". These concise video briefings furnish clients with a snapshot of present market opportunities and prevailing trends, ensuring you're always one step ahead in the investment game.

March 10, 2026

VIDEO FLASH: 4 reasons higher oil is actually positive for US equities, contrary to consensus views

VIDEO: We discuss the curious reality that higher oil is actually on balance positive for the US. This might surprise investors, but the price impacts on Monday bear this out. We look at the 4 reasons this is...

Thomas Lee, CFA

Head of ResearchAnnual Outlook

As we look ahead, our annual outlook serves as a comprehensive guide for our clients, detailing our predictions and strategies for different sectors and indexes in the upcoming year. This outlook is crucial in helping our clients position themselves for future market developments.

Tom Lee's 2026 Market Outlook

If you missed our live presentation of Tom Lee’s 2026 Market Outlook, our full replay is now available. In this year’s most important webinar, Tom lays out a framework for...

Thomas Lee, CFA

Head of Research

Mark L. Newton, CMT

Head of Technical Strategy

L. Thomas Block

Washington Policy Strategist

Market Update Webinar

Stay abreast of market trends and have your queries resolved with our Market Update webinars. These sessions are designed to provide clarity on current market conditions and assist clients in strategizing accordingly.

Special Webinars

Our special webinars are dedicated to unraveling specific market phenomena such as inflation and other vital macro metrics. These sessions provide in-depth insights, aiding clients in navigating through complex market dynamics.

CEO Interviews

Leverage our extensive network as we sit down with prominent CEOs to gain firsthand insights into the landscape of their respective sectors or sub-industries. These interviews are a goldmine of information, offering unique perspectives that can significantly impact investment strategies.

Expert Interviews

In our commitment to provide multi-faceted insights, we conduct interviews with technical experts and other key industry figures, shedding light on nuanced aspects of the market and bringing diverse perspectives to our clients.

Fund Managers Interviews

We delve into the minds of fund managers, exploring their strategies and approaches in navigating the complexities of the current macroeconomic landscape. These interviews offer a glimpse into the world of fund management, providing valuable takeaways for our clients.

Archives

Appearances Media Archives

Our researchers make appearances across a variety of media outlets including podcasts, TV shows, newspapers, and financial magazines. We diligently track and archive these appearances, creating a comprehensive media library that our clients can refer to at their convenience.

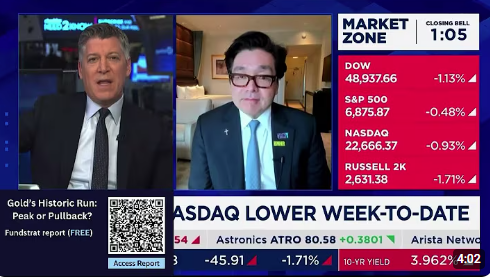

CNBC Media Archives

We maintain an archive of CNBC appearances by Tom Lee, our Head of Research, highlighting his role as a contributor of note to a premier news platform. Much more than occasional opportunities, these are regular invitations to weigh in on market-moving topics. The habit of seeing Tom on a CNBC screen underscores the degree to which the financial media recognizes his ability to consistently generate market insights – which are also available to our subscribers in greater detail and in multiple formats via our research reports, videos, webinars, and client calls.

Sample Reports

Probabilities suggest "hot" Feb core CPI above consensus of +0.30%. Jan "hot" CPI drove a 3% sell-off. But with "gas in the tank," this is a buy the dip moment.

VIDEO: February CPI is reported on Tuesday. I think there’s a risk that it’s a hot number, but it’s probably similar to January when you wanted to buy that 3% pullback that follows a hot CPI. (duration: 3:40)....

Thomas Lee, CFA

Head of ResearchJanuary on track for >3% gain, solidifying 2024 to be positive (>92% probability) and suggests our 5,200 target might be low.

VIDEO: Even more important than FOMC or even macro this week is the Wed close. Jan is on track to be positive and it supports our case for 5200 or even much higher (duration: 4:05).

Thomas Lee, CFA

Head of ResearchLatest Publications

Prediction markets see higher oil thru June = longer conflict. But we still see March as "up month"

The US attack on Iran is now in its 10th day and since then, the S&P 500 is down -1.4%. To us, the conflict is likely longer than consensus expectations (which is a short war) and perhaps the...

Thomas Lee, CFA

Head of ResearchVIDEO FLASH: 4 reasons higher oil is actually positive for US equities, contrary to consensus views

VIDEO: We discuss the curious reality that higher oil is actually on balance positive for the US. This might surprise investors, but the price impacts on Monday bear this out. We look at the 4 reasons this is...

Thomas Lee, CFA

Head of ResearchVIDEO FLASH: Oil surge to $80 prompts White House reaction. The strength in software, MAG7 and crypto continue to stand out

VIDEO: We continue to expect March to be an up month, despite war progress that seems to point to a widening conflict and growing economic impacts. The leadership has come from software, MAG7 and crypto.

Thomas Lee, CFA

Head of ResearchVIDEO FLASH: We advise adding exposure to MAG7, software $IGV and crypto, even if the 'bell' has not rung on the bottom

VIDEO: We look at the lows for markets since 2009 and what is obvious is that there is never a bell rung at the low. Just like nobody really ever sells the top. The key is identifying when...

Thomas Lee, CFA

Head of ResearchBook a Meeting

Our dedicated sales team stands by, eager to facilitate a phone meeting. Have your questions answered firsthand and obtain insights directly from the source.