Evidence-Based Research

Strategic market insights derived from emotion-free, evidence-based research by a team with more than a century of Wall Street experience.

200+

Clients

25+

Countries

75+

Market outlooks

7500+

Media appearances

What Type of Client Are You?

Institutional Investor

- We research market dynamics to equip hedge funds and banks with actionable intelligence.

- Tailored research, co-branded reports, and conferences to align with your institution's unique strategy.

RIA & Wealth Management

- Concise insights and user-friendly dashboard for quick decision-making.

- Bespoke research and co-branding opportunities to elevate your RIA brand.

Why Fundstrat?

We are an independent financial research boutique providing strategic market insights rooted in emotion-free, evidence-based research by a team with more than a century of Wall Street experience.

Work with us to benefit from our research daily via practical, actionable ideas to help you build an effective portfolio roadmap.

Get direct access to our analysts via client calls, monthly webinars, and special coverage of market moves.

Become our clientOur Research Leadership

Thomas J. Lee, CFA – Co-Founder, Head of Research

Thomas Lee is a Managing Partner and the Head of Research at Fundstrat Global Advisors. He is an accomplished Wall Street strategist with over 25 years of experience in equity research, and has been top ranked by Institutional Investor every year since 1998. Prior to co-founding Fundstrat, he served most recently as J.P. Morgan’s Chief Equity Strategist from 2007 to 2014, and previously as Managing Director at Salomon Smith Barney.

L. Thomas Block – Washington Policy Strategist

L. Thomas Block is the Washington Policy Strategist at Fundstrat, and also President of Tom Block Consults, a public policy consulting firm. Prior to starting his firm, Tom had a 21-year career at JP Morgan Chase, where he served as Global Head of Government Relations and created a Washington Research product for the firm. For 17 years he served as the senior lobbyist responsible for managing political relationships with the US government, state and local governments, and the EU and its member states. He created the bank’s EU Government Relations program. Prior to joining JP Morgan Chase in 1987, Tom was a vice president at Irving Trust Company where he started the Government Relations program for one of the nation’s 20 largest banks.He has also worked on political campaigns both as a strategist and speechwriter.

Mark L. Newton, CMT – Head of Technical Strategy

As former managing member/owner of Newton Advisors LLC, Mark has more than 25 years of buy-side and sell-side experience in finance. Before Fundstrat, he worked with Diamondback Capital Management, and with Morgan Stanley in New York City as their technical strategist. Mark has traded equity options as a market maker/floor trader on the CBOE, and worked in risk management. He is a member of the Market Technicians Association, and former member of the CBOE, CBOT, and PHLX. Mark makes regular appearances on CNBC, FOX Business, and Bloomberg.

Sean Farrell – Head of Digital Asset Research

Sean Farrell is the Head of Digital Asset Strategy at Fundstrat Global Advisors. Prior to joining Fundstrat, Sean was a manager in the Transaction Opinions group at Alvarez & Marsal, and also worked as an associate with Anvil Advisors. Sean holds a B.S. in Finance from Lehigh University.

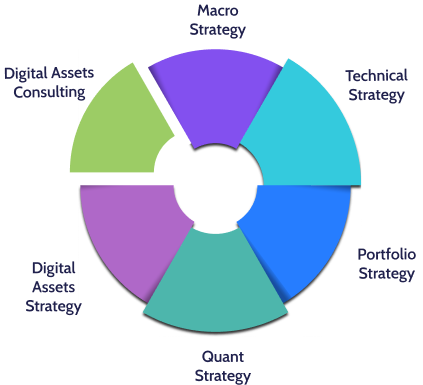

Our Approach

Evidence-Based Financial Research

We monitor key market events and data and compress all this into an easy-to-read letter that will help you understand market moves.

- Macro Strategy: We monitor key market events and data to help your firm outperform the market.

- Technical Strategy: We provide in-depth analysis and context on the technical forces impacting markets.

- Portfolio & Quant Strategy: Our quantitative approach aids in risk management, portfolio optimization, and alpha generation.

- Digital Asset Strategy: We fuse insights from analyzing this emerging asset class with a diverse range of existing market experience to create actionable recommendations.

Thomas J. Lee, CFA

Co-Founder, Head of Research

Mark L. Newton, CMT

Head of Technical Strategy

Thomas J. Lee, CFA

Co-Founder, Head of Research

Ken Xuan, CFA

Head of Quant Strategy

Sean Farrell

Head of Digital Asset Strategy

Tom Block

U.S. Policy

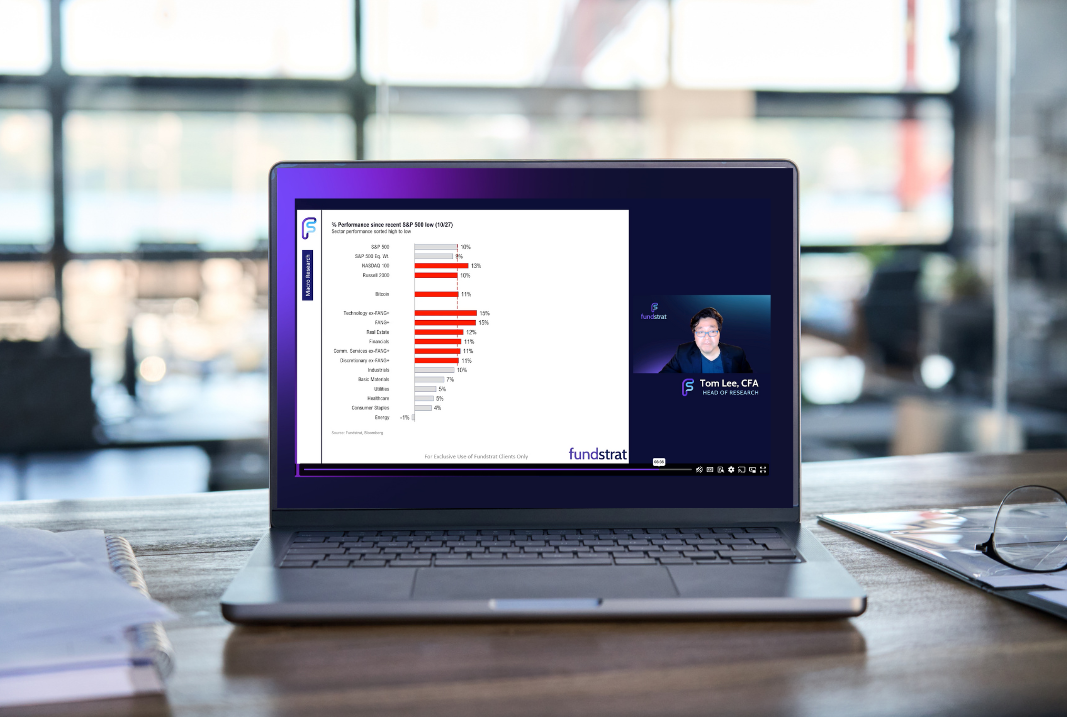

Thomas J. Lee, Head of Research, publishes market updates 3 times a week, along with analysis of vital financial headlines. He also provides a daily video 5 times per week, one of our clients’ favorite products.

- Macro data

- Macro commentary

- Charts and media

- Macro trends and opportunities

- Real-time commentary

- Daily market update videos

Latest Research

Dollar downturn along with Energy points to coming relief for risk assets

Short-term rallies look likely for US Equities along with most of Europe and Far East Equities after the initial pullback over the last couple of weeks. However, given that many indices have the same near-term wave structure, it’s thought...

Mark L. Newton, CMT

Head of Technical StrategyPrediction markets see higher oil thru June = longer conflict. But we still see March as "up month"

The US attack on Iran is now in its 10th day and since then, the S&P 500 is down -1.4%. To us, the conflict is likely longer than consensus expectations (which is a short war) and perhaps the...

Thomas Lee, CFA

Head of ResearchEnergy looks likely to "take a breather" after recent runup

The short-term breakdown for most US Equity indices over the last couple of trading days leaves near-term trends negative, but arguably still part of larger neutral consolidation patterns since last fall. The extraordinary surge in WTI & Brent Crude...

Mark L. Newton, CMT

Head of Technical StrategyVIDEO FLASH: 4 reasons higher oil is actually positive for US equities, contrary to consensus views

VIDEO: We discuss the curious reality that higher oil is actually on balance positive for the US. This might surprise investors, but the price impacts on Monday bear this out. We look at the 4 reasons this is...

Thomas Lee, CFA

Head of ResearchOur Services

We offer a comprehensive library of tools and reports designed to help our clients position themselves ahead of consensus.

Research

Tailored to the needs of institutions, RIAs, and individual investors, our research drives informed decision-making and optimal strategy alignment in a dynamic market landscape.

Market updates

We provide intraday market commentary, offering real-time insights into unfolding market events.

Media

From daily videos delving into macro and technical perspectives, to webinars featuring industry leaders and forward-looking forecasts, our media suite stands unparalleled in delivering vital market insights.

Q&A

From phone calls to face-to-face consultations, we consultant clients on portfolio assessments, the cultivation of innovative ideas and more.

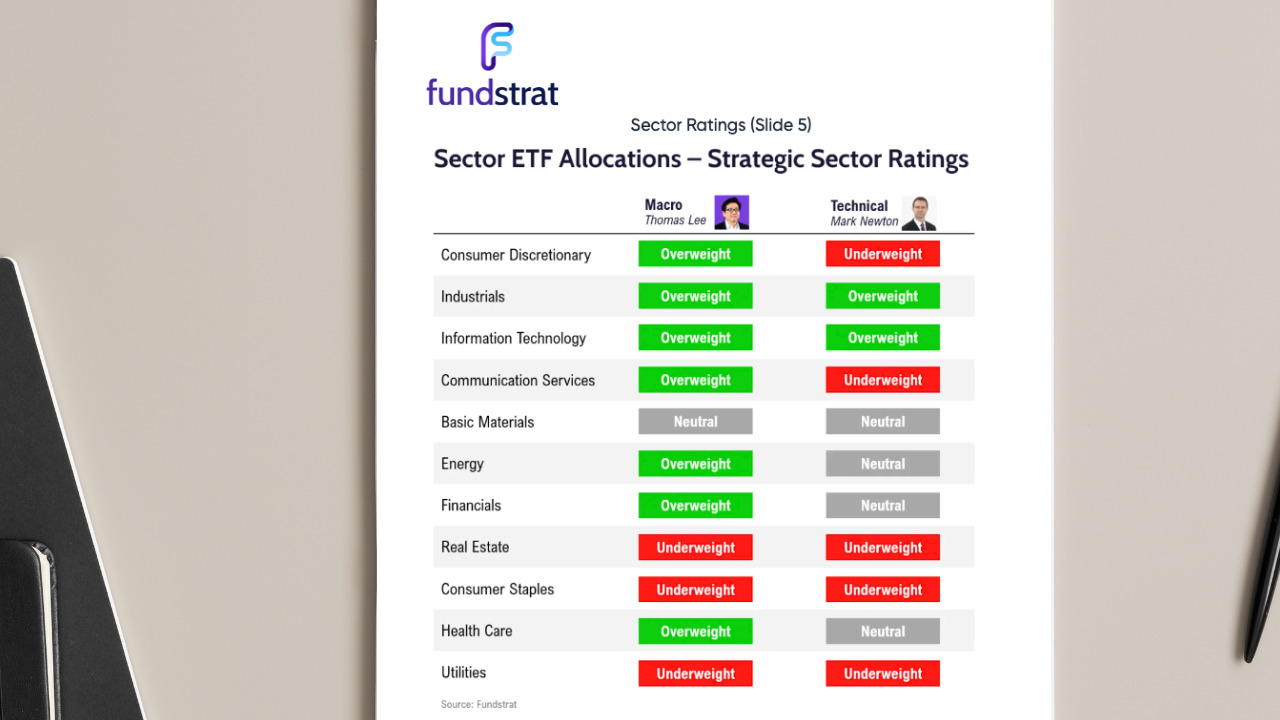

Sector analysis

Leveraging macro strategies, ETF themes, and technical analysis, our proprietary sector model anticipates sector rotations and shifts, guiding you toward optimized portfolio performance.

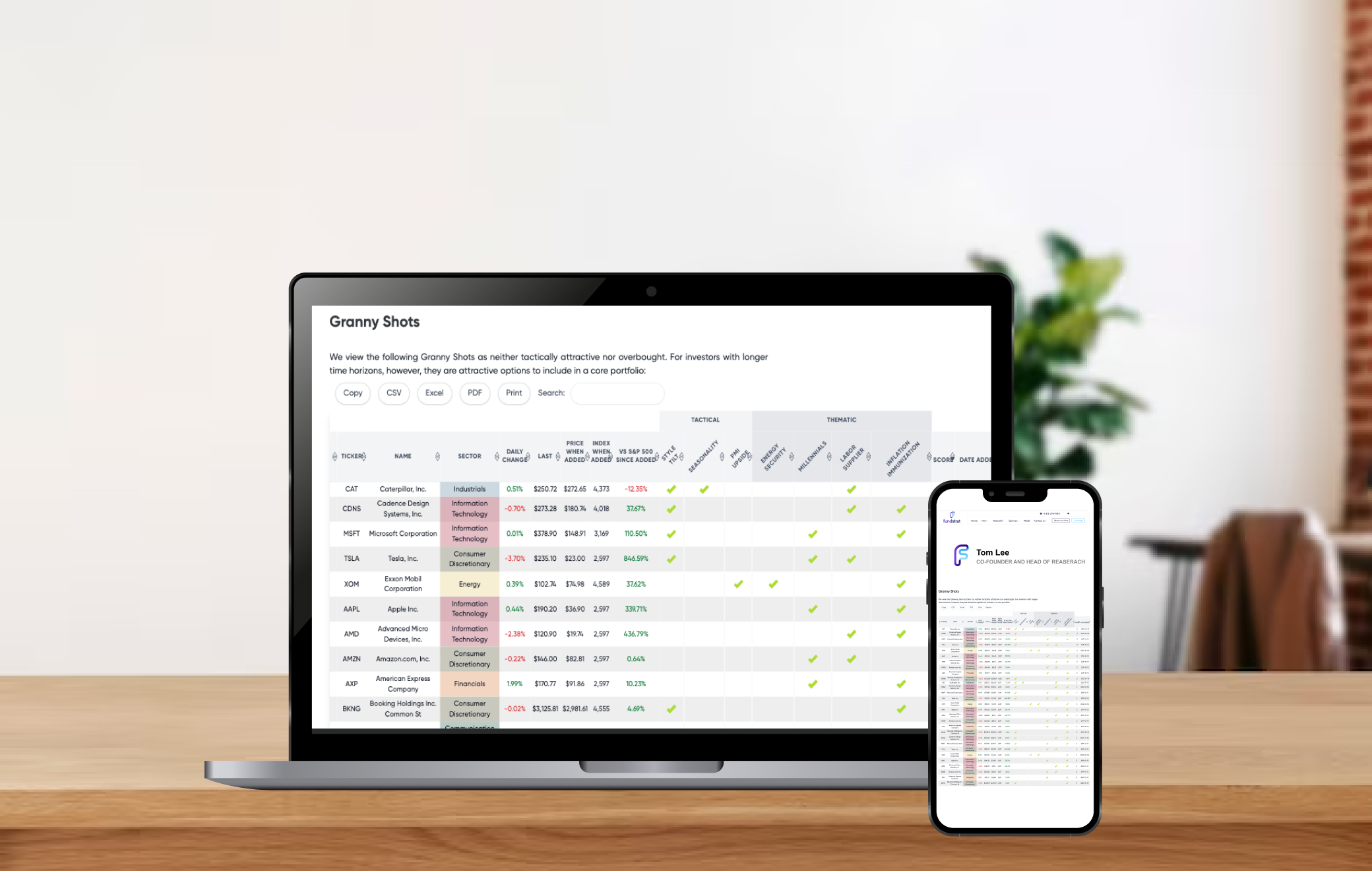

Actionable ideas

Drawing on real-time market events and prevailing themes, we provide curated stock lists and actionable insights to generate alpha.

Contact Us

Email:

Call:

Visit:

150 East 52nd St, 3rd Floor, New York, NY 10022