Institutional Client Services

Fundstrat is uniquely positioned to support the strategy of hedge funds and institutional money managers, harnessing our unparalleled expertise to provide actionable insights, strategies, and tailored solutions that resonate with their sophisticated needs. Equipped to amplify your investing prowess and drive your institution's growth, Fundstrat is the trusted partner of banks and hedge funds seeking a competitive edge.

Our Research

Macro Strategy

Thomas J. Lee, CFA

Technical Strategy

Mark L. Newton, CMT

Portfolio Strategy

Thomas J. Lee, CFA

Quantitative Strategy

Ken Xuan, CFA, FRM

U.S. Policy

L . Thomas Block

Digital Asset Strategy

Sean Farrell

Sector and Stock Recommendations

Latest Research

VIDEO FLASH: Oil surge to $80 prompts White House reaction. The strength in software, MAG7 and crypto continue to stand out

VIDEO: We continue to expect March to be an up month, despite war progress that seems to point to a widening conflict and growing economic impacts. The leadership has come from software, MAG7 and crypto.

Thomas Lee, CFA

Head of ResearchAgriculture rally getting underway; Grains should be overweighted

US Equity trends remain choppy with regard to SPX and QQQ, while indices like DJIA and Equal-weighted SPX have pushed lower this week. Crude oil, the US Dollar, and Treasury yields continue to press higher, and this likely should...

Mark L. Newton, CMT

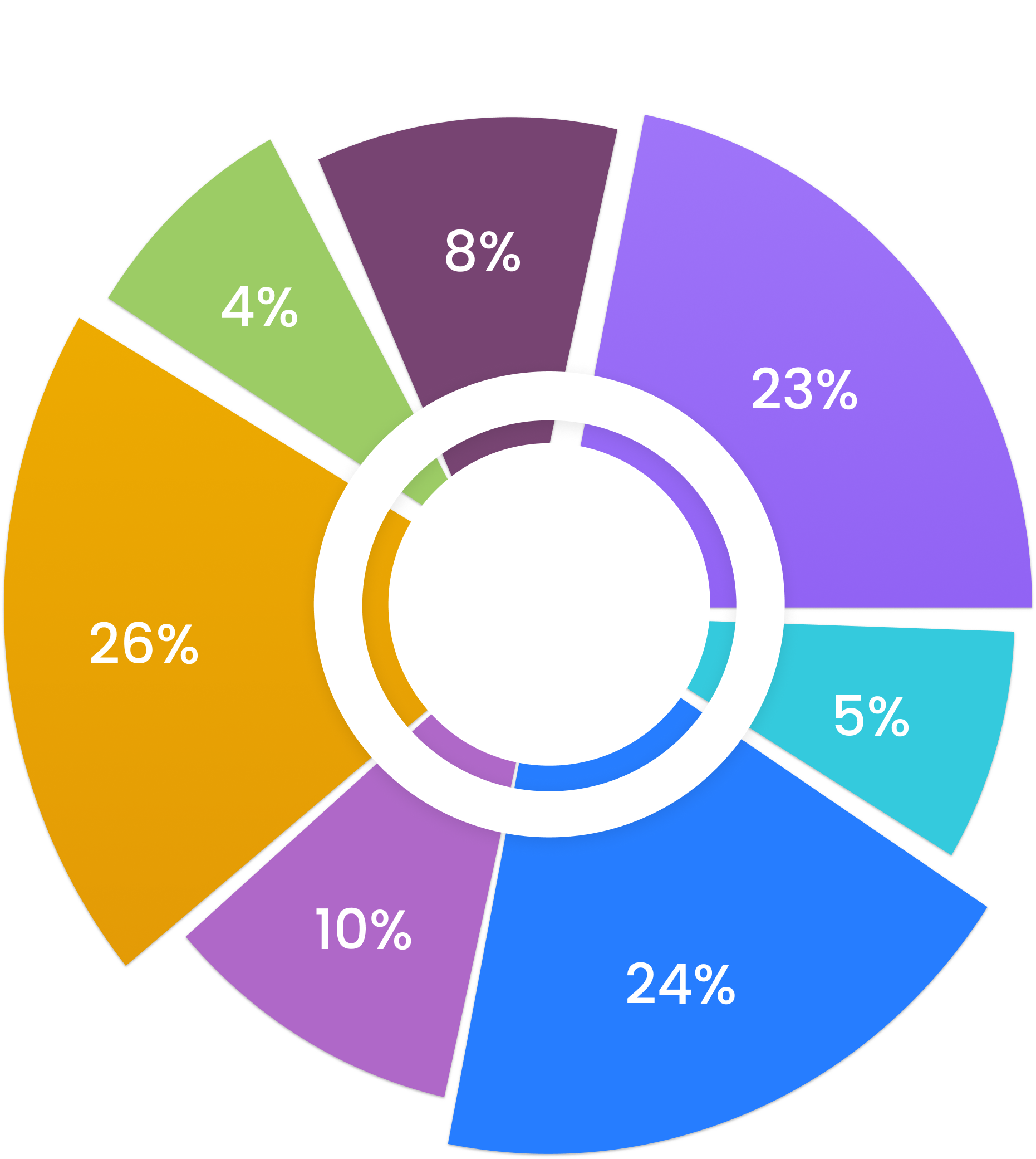

Head of Technical StrategyMarch 2026 Sector Allocation Update

Since entering 2026, equity markets have in fact performed well. On the Jan. 28 trading session, the S&P 500 briefly moved above the 7,000 level for the first time. Two relatively large drawdowns occurred following President Trump’s threat...

Fundstrat Team

VIDEO FLASH: We advise adding exposure to MAG7, software $IGV and crypto, even if the 'bell' has not rung on the bottom

VIDEO: We look at the lows for markets since 2009 and what is obvious is that there is never a bell rung at the low. Just like nobody really ever sells the top. The key is identifying when...

Thomas Lee, CFA

Head of Research

Annual Market Outlooks

At Fundstrat, we understand the need for institutions to stay ahead of the market. Our annual outlooks, covering all research verticals, offer a clear overview of expected market trends. Accompanied by mid-year updates, these forecasts ensure that institutions have the timely insights needed to adjust their strategies, promoting robust decision-making throughout the year.

The Benefits of Partnership

We believe that the most successful strategies are born of collaborative efforts. Partner with us for a bespoke blend of high-quality research and strategic insights tailored to your specific needs. Our partnership goes beyond simple reports: we commit ourselves to your success and work with you hand in hand to turn market challenges into investment opportunities.

Sector Positioning and Strategy

We go beyond mere analysis, offering targeted sector positioning and curated stock lists geared toward immediate action. Recognizing the specialized mandates and strategies of hedge funds and banks, our research pinpoints not just opportunities, but actionable pathways tailored to institutional needs. Steeped in rigorous analysis spanning multiple research dimensions, our insights allow financial firms to seamlessly integrate our recommendations, fortifying their strategies and staying ahead of market dynamics.

Client Portal

When creating our extensive research library, we stressed easy accessibility and seamless navigation. That’s why we offer a comprehensive library of tools designed to help our clients quickly locate pertinent information and put it to use. Central to this is our client dashboard – a user-friendly interface clients use to access, track, and manage all our insights, the better to leverage Fundstrat’s research in their decision-making.

Webinars and Conference Attendance

As part of our aim to provide comprehensive analysis and unparalleled insights, we host over 20 webinars annually. These sessions range from exclusive talks by guest speakers renowned in the financial world to in-depth explorations of technical strategies and macro trends. We also curate webinars addressing real-time market happenings or emergent financial events.

Latest Webinars

Tue, Mar 17 2:00 ET

Live Technical Analysis with Mark Newton - March 2026

Join us on Tuesday,March 17, at 2pm ET for an interactive webinar open to Fundstrat clients only. On this live call, Fundstrat’s Head of Technical Strategy, Mark Newton, will answer your questions and provide a market update featuring near-term opportunities. Can’t make it? Don’t worry, we’ve got you covered. A replay will be made available shortly after the event.

Mark L. Newton, CMT

Head of Technical Strategy

Wed, Mar 18 11:00 ET

Macro Update & Top Ideas - March 2026

Join us on Wednesday, March 18 at 11am ET for a live webinar and interactive Q&A with Fundstrat’s Head of Research, Tom Lee, and Head of Technical Strategy, Mark Newton. The session begins with a macro market update, followed by this month’s Top Ideas, where Tom and Mark deliver a focused deep dive into the opportunities they find most compelling in today’s market environment. In this webinar, you will: -Synthesize Tom and Mark’s near-daily commentary into a clear market framework -Discuss this month’s top 5 large-cap and top 5 SMID-cap stock ideas -Engage directly with Tom and Mark during a live client Q&A Can’t attend live? A full replay will be made available to members shortly after the event.

Thomas Lee, CFA

Head of Research

Mark L. Newton, CMT

Head of Technical Strategy

Idea Calls

Ensuring a seamless synergy between our insights and your strategies, our dedicated sales team stands ready to coordinate idea calls directly with our analysts. These sessions are designed as in-depth discussions of our findings, allowing clients to align our research with their unique strategies and targets. By facilitating this direct dialogue, we ensure that your investment decisions are both informed and custom, resonating with the latest actionable market intelligence.

Institutional Passes: Amplifying Strategic Partnerships

Grant your institutional partners exclusive access to Fundstrat's expert-led webinars. Use our comprehensive research and market insights as the foundation of meaningful engagement and as proof of your commitment to shared financial aspirations. Fundstrat can help elevate your institutional collaborations and buttress your status as a thought leader. Share the expertise, fortify the alliance.

Bespoke Research

Sample of Tailored Research Solutions on Demand:

Download a Sample Report of Inflation DataUpon special request – and coordinated via our sales team – we provide bespoke research for clients. Whether it’s to adjust existing models, consult on specific market conundrums, or develop new predictive frameworks, our team stands ready to offer expert insight and advice. Our aim is to ensure that our clients have the tools and knowledge they need to achieve their goals.

Client Calls

Consistent communication is key to a successful partnership, which is why we host monthly calls to discuss our latest research and align our products with your evolving goals. Each call is an open dialogue, aiming for a better understanding of the market and your place in it.

Contact Us

Email:

Call:

Visit:

150 East 52nd St, 3rd Floor, New York, NY 10022