Institutional Client Services

Fundstrat is uniquely positioned to support the strategy of hedge funds and institutional money managers, harnessing our unparalleled expertise to provide actionable insights, strategies, and tailored solutions that resonate with their sophisticated needs. Equipped to amplify your investing prowess and drive your institution's growth, Fundstrat is the trusted partner of banks and hedge funds seeking a competitive edge.

Our Research

Macro Strategy

Thomas J. Lee, CFA

Technical Strategy

Mark L. Newton, CMT

Portfolio Strategy

Thomas J. Lee, CFA

Quantitative Strategy

Ken Xuan, CFA, FRM

U.S. Policy

L . Thomas Block

Digital Asset Strategy

Sean Farrell

Sector and Stock Recommendations

Latest Research

VIDEO FLASH: Prediction markets continue to point to a longer war. But keep in mind, 68% of S&P 500 has been in a rolling bear market = signs of a bottom

VIDEO: As we noted in several recent notes, we believe this Iran war is likely longer than the administration and consensus expected. That said, high oil, in our view, is not necessarily bearish for US stocks. We review...

Thomas Lee, CFA

Head of ResearchTwo-year Yields might not trend higher as quickly as many expect

SPX weakness looks to be nearing key make-or-break territory, but unless this week’s lows are violated and hold on a weekly close, it still looks likely that rallies back to test 6900-6950 could occur over the next 1-2...

Mark L. Newton, CMT

Head of Technical StrategyDollar downturn along with Energy points to coming relief for risk assets

Short-term rallies look likely for US Equities along with most of Europe and Far East Equities after the initial pullback over the last couple of weeks. However, given that many indices have the same near-term wave structure, it’s thought...

Mark L. Newton, CMT

Head of Technical StrategyPrediction markets see higher oil thru June = longer conflict. But we still see March as "up month"

The US attack on Iran is now in its 10th day and since then, the S&P 500 is down -1.4%. To us, the conflict is likely longer than consensus expectations (which is a short war) and perhaps the...

Thomas Lee, CFA

Head of Research

Annual Market Outlooks

At Fundstrat, we understand the need for institutions to stay ahead of the market. Our annual outlooks, covering all research verticals, offer a clear overview of expected market trends. Accompanied by mid-year updates, these forecasts ensure that institutions have the timely insights needed to adjust their strategies, promoting robust decision-making throughout the year.

The Benefits of Partnership

We believe that the most successful strategies are born of collaborative efforts. Partner with us for a bespoke blend of high-quality research and strategic insights tailored to your specific needs. Our partnership goes beyond simple reports: we commit ourselves to your success and work with you hand in hand to turn market challenges into investment opportunities.

Sector Positioning and Strategy

We go beyond mere analysis, offering targeted sector positioning and curated stock lists geared toward immediate action. Recognizing the specialized mandates and strategies of hedge funds and banks, our research pinpoints not just opportunities, but actionable pathways tailored to institutional needs. Steeped in rigorous analysis spanning multiple research dimensions, our insights allow financial firms to seamlessly integrate our recommendations, fortifying their strategies and staying ahead of market dynamics.

Client Portal

When creating our extensive research library, we stressed easy accessibility and seamless navigation. That’s why we offer a comprehensive library of tools designed to help our clients quickly locate pertinent information and put it to use. Central to this is our client dashboard – a user-friendly interface clients use to access, track, and manage all our insights, the better to leverage Fundstrat’s research in their decision-making.

Webinars and Conference Attendance

As part of our aim to provide comprehensive analysis and unparalleled insights, we host over 20 webinars annually. These sessions range from exclusive talks by guest speakers renowned in the financial world to in-depth explorations of technical strategies and macro trends. We also curate webinars addressing real-time market happenings or emergent financial events.

Latest Webinars

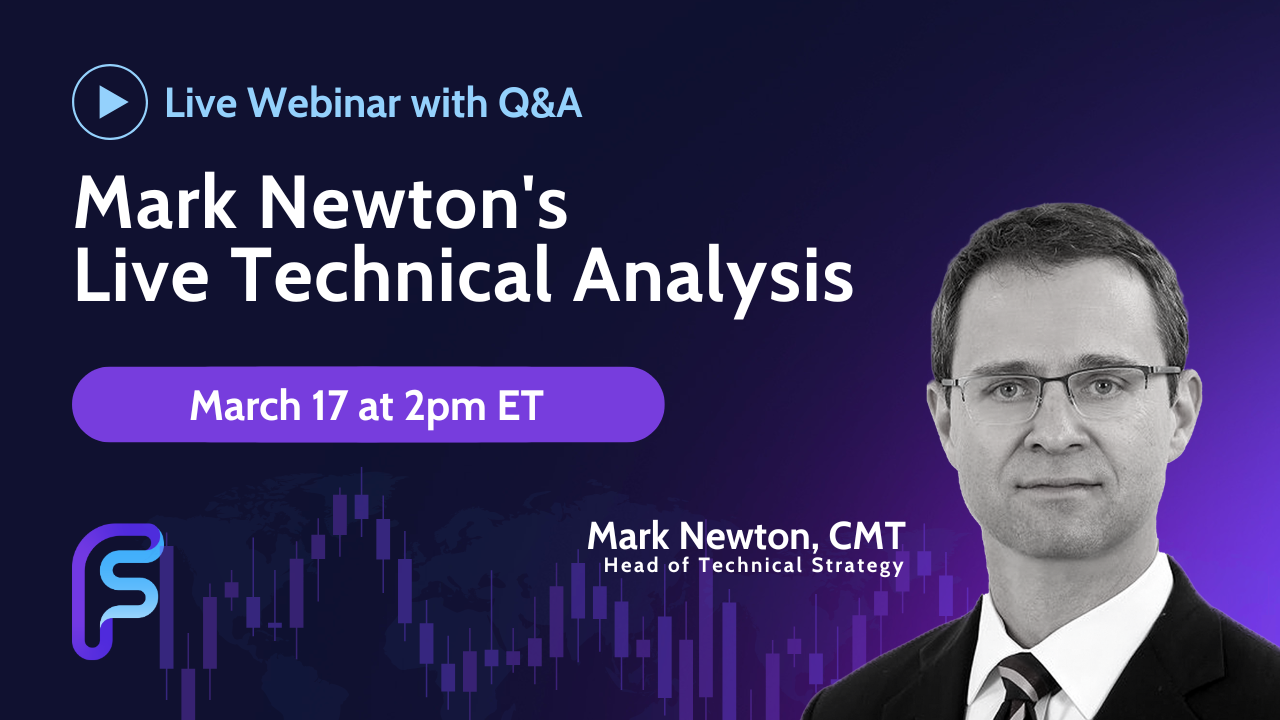

Tue, Mar 17 2:00 ET

Live Technical Analysis with Mark Newton - March 2026

Join us on Tuesday,March 17, at 2pm ET for an interactive webinar open to Fundstrat clients only. On this live call, Fundstrat’s Head of Technical Strategy, Mark Newton, will answer your questions and provide a market update featuring near-term opportunities. Can’t make it? Don’t worry, we’ve got you covered. A replay will be made available shortly after the event.

Mark L. Newton, CMT

Head of Technical Strategy

Wed, Mar 18 2:00 ET

Crypto Market Update Webinar - March 2026

Join us on Wednesday, March 18 at 2pm ET for a comprehensive crypto webinar with Mark Newton (Fundstrat Head of Technical Strategy) and Sean Farrell (Fundstrat Head of Digital Assets Strategy), blending technical and fundamental insights across major digital assets. We’ll break down key price levels, on-chain trends, and upcoming catalysts shaping the next phase of the market, offering clear, data-driven insight into where the sector may be headed next and where new opportunities may emerge. Can’t make it? We’ve got you covered. As always, a replay will be available to clients shortly after the live event concludes.

Mark L. Newton, CMT

Head of Technical Strategy

Sean Farrell

Head of Digital Asset Strategy

Idea Calls

Ensuring a seamless synergy between our insights and your strategies, our dedicated sales team stands ready to coordinate idea calls directly with our analysts. These sessions are designed as in-depth discussions of our findings, allowing clients to align our research with their unique strategies and targets. By facilitating this direct dialogue, we ensure that your investment decisions are both informed and custom, resonating with the latest actionable market intelligence.

Institutional Passes: Amplifying Strategic Partnerships

Grant your institutional partners exclusive access to Fundstrat's expert-led webinars. Use our comprehensive research and market insights as the foundation of meaningful engagement and as proof of your commitment to shared financial aspirations. Fundstrat can help elevate your institutional collaborations and buttress your status as a thought leader. Share the expertise, fortify the alliance.

Bespoke Research

Sample of Tailored Research Solutions on Demand:

Download a Sample Report of Inflation DataUpon special request – and coordinated via our sales team – we provide bespoke research for clients. Whether it’s to adjust existing models, consult on specific market conundrums, or develop new predictive frameworks, our team stands ready to offer expert insight and advice. Our aim is to ensure that our clients have the tools and knowledge they need to achieve their goals.

Client Calls

Consistent communication is key to a successful partnership, which is why we host monthly calls to discuss our latest research and align our products with your evolving goals. Each call is an open dialogue, aiming for a better understanding of the market and your place in it.

Contact Us

Email:

Call:

Visit:

150 East 52nd St, 3rd Floor, New York, NY 10022