Client Portal

Data Center

Access our research through the lens of our charts and tables. View all of our charts (sorted by publishing date) on the left, and click on any chart to read the report in which it appeared.

Select the image you are interested in to load the corresponding report in the content section. This intuitive layout ensures that you can easily find and view reports based on their visual thumbnails.

-

VIDEO FLASH: Private credit fears further roil markets. But we overall view this as a "wall of worry" and we continue to believe we are nearing end of downside selling

Thu, February 19, 2026 | 10:26PM ET -

VIDEO FLASH: Private credit fears further roil markets. But we overall view this as a "wall of worry" and we continue to believe we are nearing end of downside selling

Thu, February 19, 2026 | 10:26PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

NVDA earnings and AAPL trend are key to watch over the next 2 weeks

Thu, February 19, 2026 | 6:45PM ET -

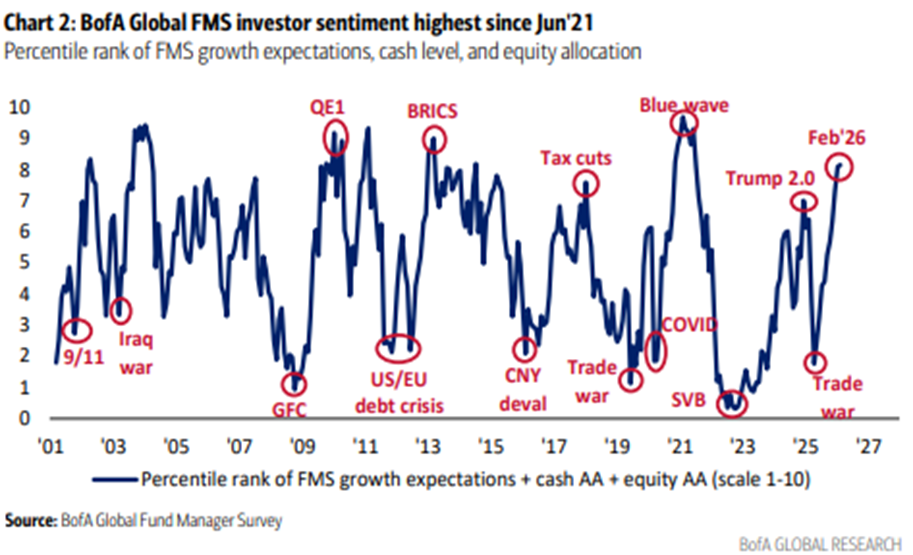

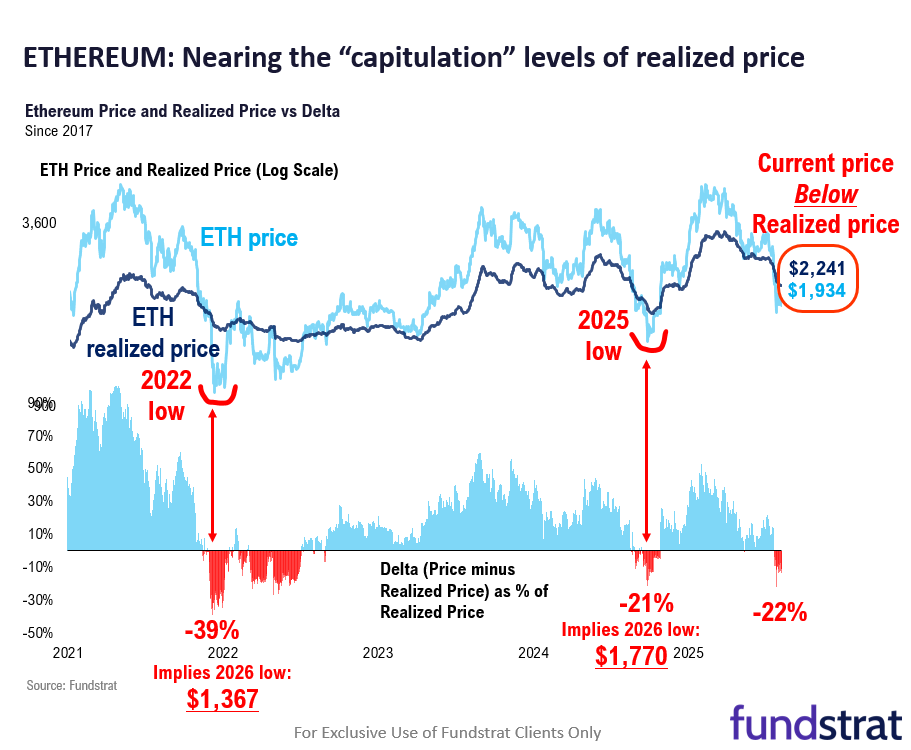

Positioning Stretched, Macro Crosscurrents Build, Crypto Showing Relative Resilience

Thu, February 19, 2026 | 6:35PM ET -

Nvidia Does Some Pruning of Its AI Portfolio Bonsai

Thu, February 19, 2026 | 8:42AM ET

Thomas Lee, CFA AC

VIDEO FLASH: Private credit fears further roil markets. But we overall view this as a "wall of worry" and we continue to believe we are nearing end of downside selling

VIDEO: Since 1950, when both first week of Jan is positive and the month of Jan is positive, the full year tends to be strong. And that remains our base case. But our analysis also shows Feb tends to be a coin flip. And with this growing wall of worry, we see this downside pressure nearing its peak. In the meantime, we expect overall macro data to be solid.

More in today’s Macro Minute video linked here (duration: 5:13).

To unsubscribe from this email, please click here. You can also manage your email preferences and opt out of other types of emails by clicking here.