Client Portal

Colgate-Palmolive

Mark L. Newton, CMT AC

Head of Technical Strategy

Mon, November 4, 2024 | 12:26PM ET

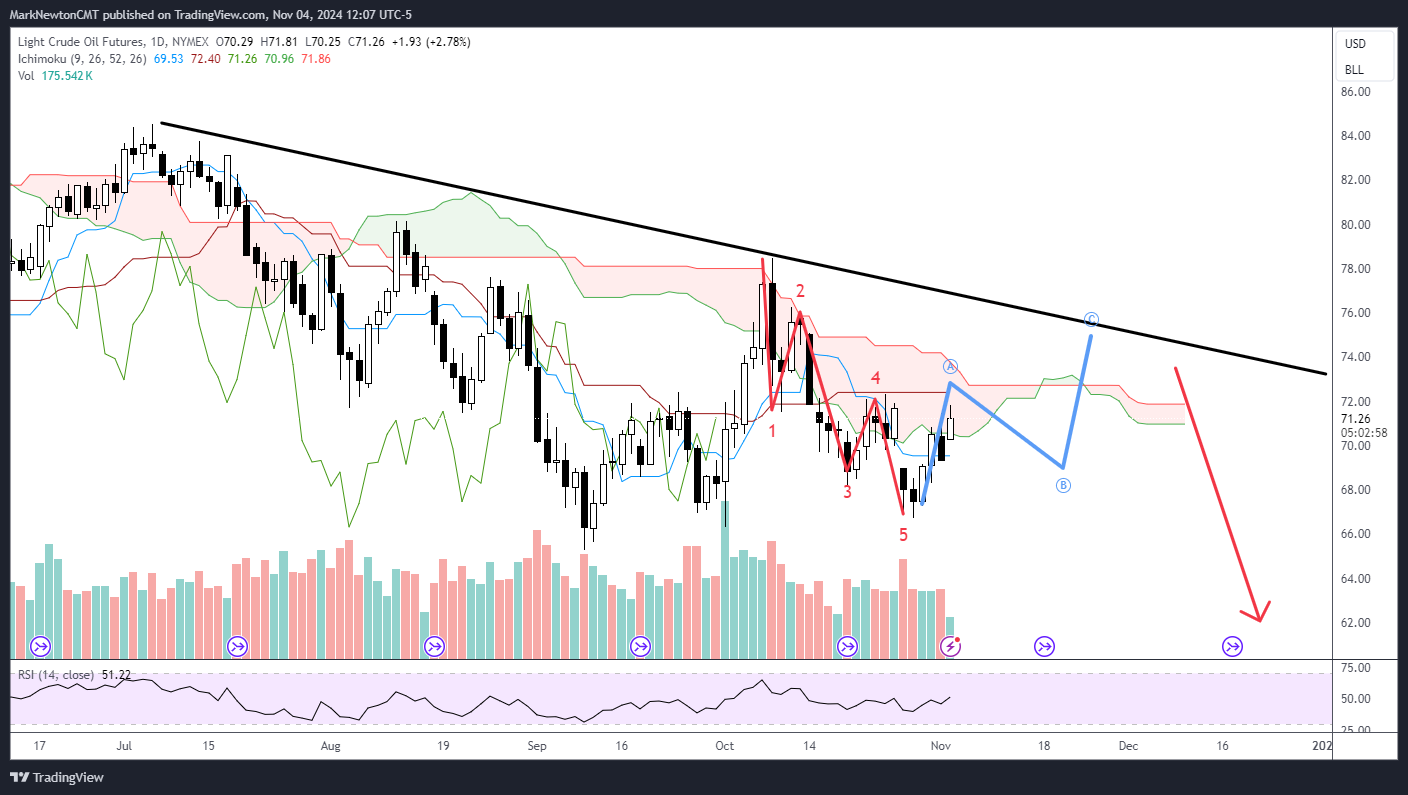

Big news over the weekend concerned OPEC+ delaying the return of Output reduction by one month and Crude bouncing also potentially on news of retaliation by Iran to attacks by Israel post the US Election. As daily WTI Crude (front month) futures charts show, the decline in October was likely a clear five-wave decline. Thus, while a minor bounce is underway, it likely won't prove too strong before another pullback down to new lows in December. Volatility has risen for Crude, but not unlike what's being seen in many assets ahead of the Election. Technicals for both C0.00% rude and Energy as a sector are negative into next year, and bounces should be seen as temporary before prices turn back lower. (CL-1.21% _F) XLE0.14% OIH-0.38%

Mark L. Newton, CMT AC

Head of Technical Strategy

Wed, October 2, 2024 | 10:53AM ET

Lot of investors wondering if C0.00% rude is bottoming, and i do NOT feel this is the case technically, though i can make the case for another 2-4 days of gains back up to 73.45-74.50 before this peaks and goes back to the lows. Structurally this remains bearish, Elliott patterns suggest a good likelihood of $50 oil, DeMark exhaustion is not in place and cycles remain bearish until Summer 2025. Thus, while a short-term bounce is certainly underway for Energy as a sector as Geopolitical risk has elevated, i don't suspect this will prove long-lasting. Technically speaking, bounces would be used to Trim/take profits/hedge Energy as of early next week. (CL-1.21% _F) OIH-0.38% XLE0.14%

Mark L. Newton, CMT AC

Head of Technical Strategy

Wed, October 4, 2023 | 9:30AM ET

WTI Crude has quietly lost almost 7% off its peak in the last week, but nearing support, and the wave structure suggests a bottom this week and a push back to minor new highs. I'll discuss my projections for Energy and Crude in tonight's report, but this first pullback makes Crude and by extension, Energy, an attractive risk/reward, and i expect a push back to 96-98 in front month Crude FuturesCL-1.21% _FXLE0.14% OIH-0.38%

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19144.1

|

-1.72%

|

|

S&P 500 INDEX

|

5799.8

|

-1.61%

|

|

10Y Treasury Yield

|

4.776

|

+1.77%

|

Last updated: 2025-01-10 15:50:01