Client Portal

Southwest Airlines

-

LUV

-

$33.24

-

+1.09%

-

$33.05

-

$33.58

-

$32.69

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, January 23, 2024 | 11:57AM ET

Today's market action is largely defensive in US Stocks, being led by Cons Staples (PG-2.26% ,CHD-1.12% ,EL0.00% ,KMB-1.70% leading) while Telecom also making good strides on positive VZ news. Airliner stocks likeUAL3.18% ,LUV1.09% , andAAL4.23% along withDAL8.65% are all up more than 3%. SPX is lower by jjust 6 points, but strength is largely only in major groups like Comm Svcs +0.90% and Staples +0.50 while REITS, Discretionary, and Healthcare are all lower by -0.50-0.75%. US Dollar along with Yields are both pushing higher again, and this move looks likely to extend into February before a turn back lower. The chart below is VZ, as Telecom lead strength within the Comm Svcs group- Note that VZ bottomed at nearly exact 50% absolute retracement of its peak in late 2020, and has turned up sharply in recent weeks. VZ target is in the mid-40s where i expect this will encounter resistance before it gets above its own 50% retracement level- Telecom attractive for short-term only given this recent surge in momentum, but both T and VZ, have meaningful intermediate-term downtrends and expect this slows both these stocks over next month. For those sniffing out Telecom, its TMUS that stands out as being most attractive- Below is Verizon -VZ-3.12%

Mark L. Newton, CMT AC

Head of Technical Strategy

Wed, December 20, 2023 | 1:30PM ET

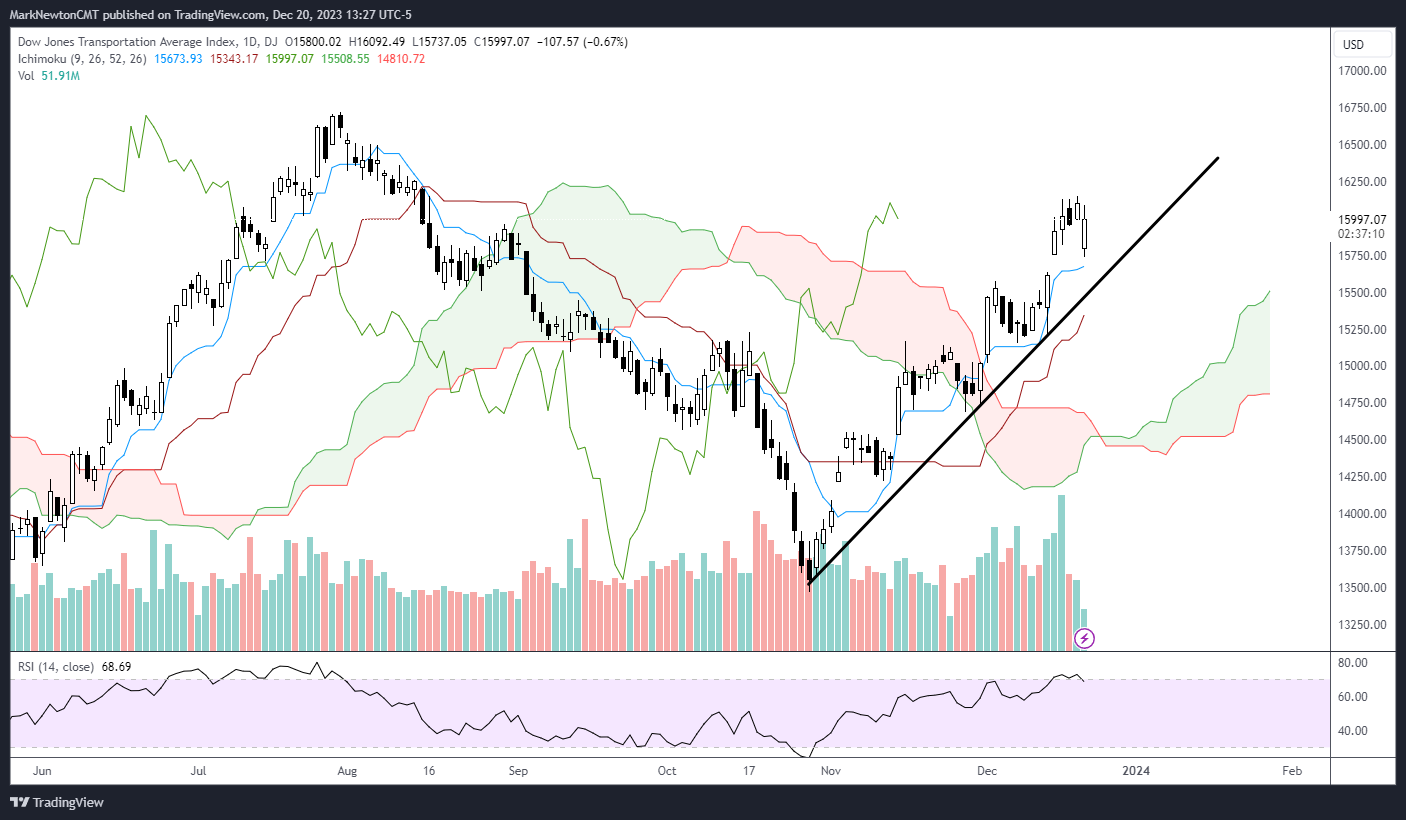

Fractional gains today out of major indices, and still seeing Small-cap strength, though the large-cap gains inGOOGL-1.02% AMZN-1.42% HD0.70% are serving to hold indices "in the green" despite six of 11 sectors being down in trading. Energy and REITS are Sector Standouts today, along with +0.33% gains in Industrials. this might not be apparent with XLI given the FDX decline which is negatively affecting the Transportation Avg, but stocks like CAT along with Rail and Trucker strength, not to mention Airlines (LUV1.09% ) are helpful to why the Equal-weighted Industrials group is positive. Outside Equities, Bitcoin is finally making a strong move to break its triangle pattern today and crypto is largely positive. Silver is leading precious metals today and US yields are fractionallly lower but have stablized in recent days along with US Dollar- SPX continues to have resistance at 4818, which following the most overbought daily RSI reading since Jan 2018, might offer some near-term resistance to this rally- See the Transportation Avg -0.50% loss whch hasn't made a dent in the ongoing uptrend

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19144.1

|

-1.72%

|

|

S&P 500 INDEX

|

5799.8

|

-1.61%

|

|

10Y Treasury Yield

|

4.776

|

+1.77%

|

Last updated: 2025-01-10 15:50:01