Client Portal

Salesforce

Mark L. Newton, CMT AC

Head of Technical Strategy

Wed, December 4, 2024 | 12:21PM ET

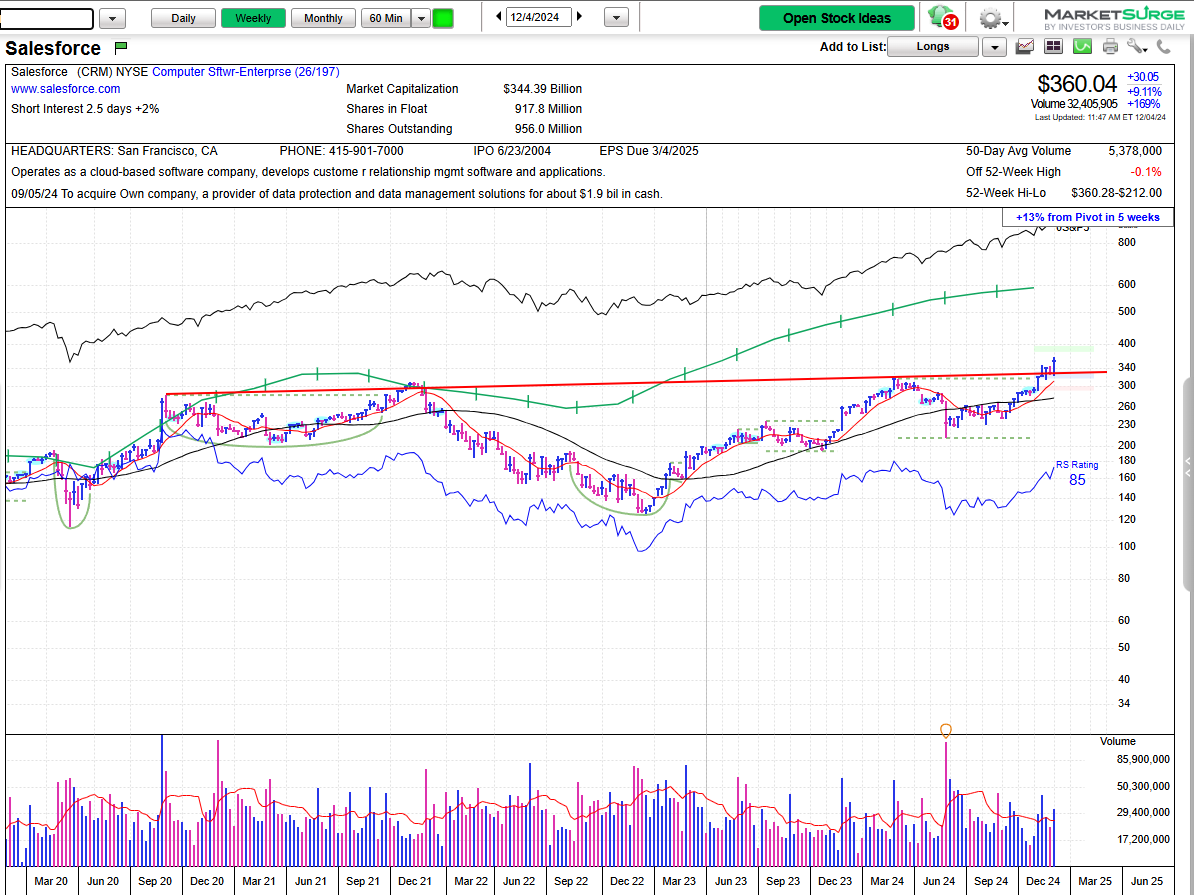

Recent UPTICKS addition CRM-2.77% Salesforce.com (11/22/24) gapped higher this morning after strong 3Q results that exceeded analyst's estimates and Agentforce (CRM's AI agent product) closed more than 200 deals during the quarter. As can be seen here, not only did CRM break out above the early November highs, but has followed through aggressively after exceeding February 2024 highs which was thought to represent the "neckline" of a large four-year Reverse Head and Shoulders technical formation. My original upside resistance listed was $372, and then $403, but this week's follow-through is quite encouraging technically.

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, October 8, 2024 | 11:57AM ET

Time to refresh comments on IGV-2.04% , the Ishares expanded Tech-Software ETF, as this is now exceeding 90, and officially breaking out above two prior peaks from this year along with Nov 2021 in a very bullish Cup and Handle pattern back to new all-time high territory. While Semis still are outperforming Software on an intermediate-term basis, Software has shown better relative strength since this Summer. Note, this Software outperformance is not the normal MSFT-1.32% led rally. Rather, it's being led by PLTR-1.44% , ORCL-5.27% , NOW-2.34% , and strong movement out of the likes of CRM-2.77% , PANW0.34% which i suspect should rally back to all-time highs. (More on this topic in tonight's report)

Mark L. Newton, CMT AC

Head of Technical Strategy

Thu, May 30, 2024 | 9:33AM ET

CRM-2.77% (Salesforce) set to open down nearly 17% on the open.. after reporting weak Revenue growth and disappointing guidance. Slowest quarter for the company since it came public, & this would be the biggest drop since 2008. Software companies seem to be slow to capitalize on the AI boom compared to chip makers and indicative of a weak IT Spending environment. Technically,,this pullback is finding support early on at the area right by the open gap from last Fall near $225. Given the huge volume on today's early morning downward gap, it would be helpful if the stock could close up from earlier losses to hold the uptrend from late 2022 which intersects near 235. Any weekly close under $225 however, likely would result in further downward pressure to initially test last Fall's lows near $194 before much stabilization. Overall, it's difficult to make much of a case that CRM is more attractive on a high volume gap down, but much will depend on how the stock can react today and tomorrow to end the week and month. Stabilization to this pullback is important, and makes it important to keep a close eye on other Cloud Software leaders like Service Now and Workday.

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19158.1

|

-1.65%

|

|

S&P 500 INDEX

|

5806.6

|

-1.50%

|

|

10Y Treasury Yield

|

4.776

|

+1.77%

|

Last updated: 2025-01-10 16:00:01