Client Portal

Oracle

-

ORCL

-

$154.55

-

-5.27%

-

$159.20

-

$159.20

-

$153.92

Included in the following strategies

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, October 8, 2024 | 11:57AM ET

Time to refresh comments on IGV-2.04% , the Ishares expanded Tech-Software ETF, as this is now exceeding 90, and officially breaking out above two prior peaks from this year along with Nov 2021 in a very bullish Cup and Handle pattern back to new all-time high territory. While Semis still are outperforming Software on an intermediate-term basis, Software has shown better relative strength since this Summer. Note, this Software outperformance is not the normal MSFT-1.27% led rally. Rather, it's being led by PLTR-1.44% , ORCL-5.27% , NOW-2.34% , and strong movement out of the likes of CRM-2.77% , PANW0.34% which i suspect should rally back to all-time highs. (More on this topic in tonight's report)

Mark L. Newton, CMT AC

Head of Technical Strategy

Wed, June 12, 2024 | 10:06AM ET

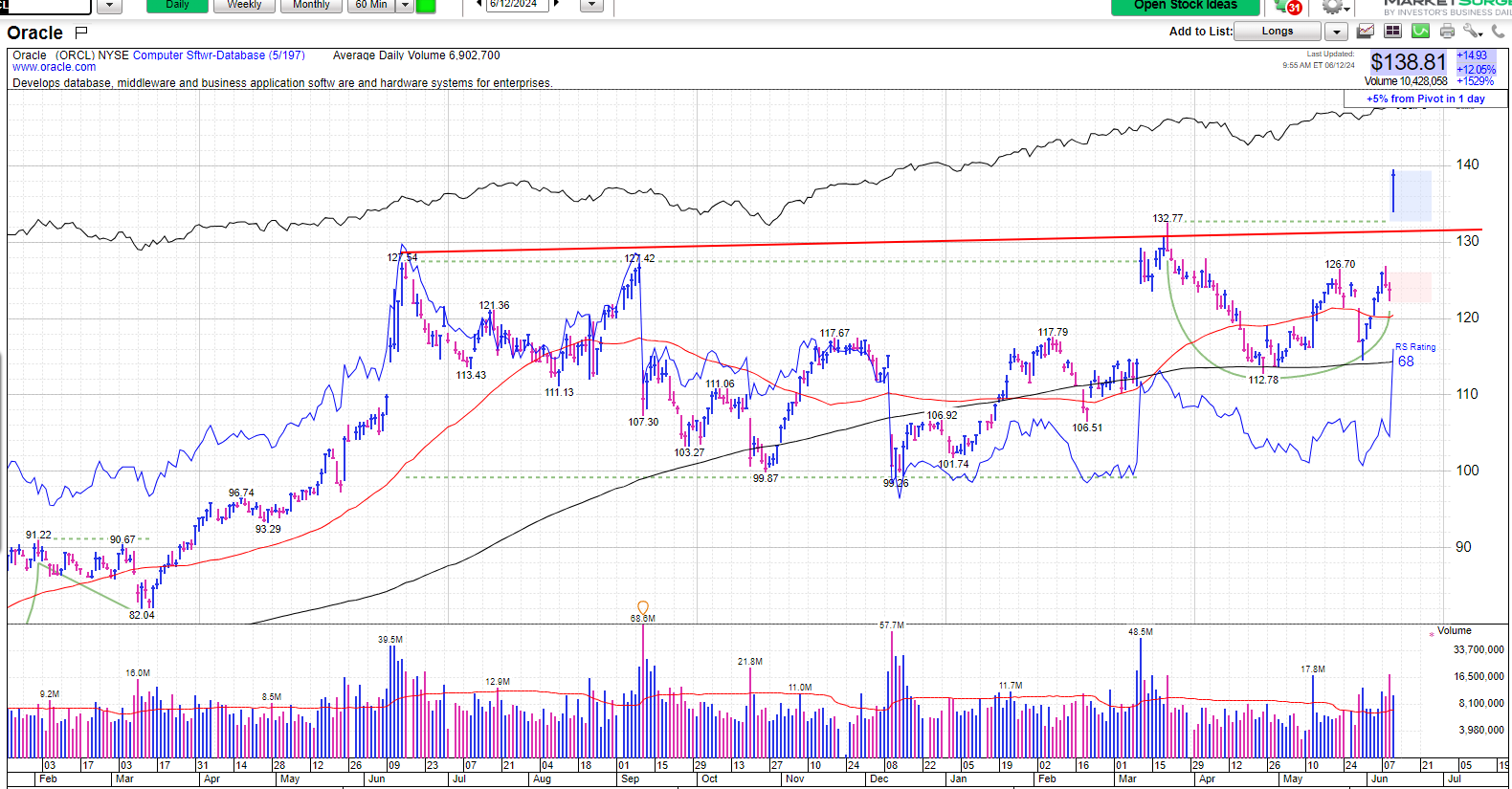

AI-fueled Cloud growth and FY 2026 Revenue expectations helping our UPTICKS stock ORCL-5.27% stage a massive breakout at today's open, rising above peaks which have been in place since last June. Excellent Cup and Handle base in ORCL, and volume is spiking on this breakout above 132. I anticipate a move up to $160, and ORCL has finally, conclusively broken out of its 1 year range, right near the 1-year anniversary of last year's peak. This has improved technically & any minor pullbacks should prove short-lived and would make this more attractive, with strong support now near the pivot area of today's breakout near $132

Mark L. Newton, CMT AC

Head of Technical Strategy

Fri, June 7, 2024 | 2:26PM ET

ORCL-5.27% has now risen six straight days, and has successfully managed to avoid much of the technical damage that happened to many Software stocks lately after CRM's bearish earnings announcement. ORCL now lies at an important "line in the sand" as it would take just a daily close above late May peaks at $126.70 to allow for a larger breakout. ORCL peaked out last year almost exactly one year ago on 5/15 and despite the bullish base underway, has shown little to no real progress. Above 126.70 would be the first sign of technical breakout and then above 132 would allow for a sharp rally back above 140. Overall, despite a lack of progress in ORCL in the last year, its base building looks attractive for expecting an eventual upside breakout

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, March 12, 2024 | 4:02PM ET

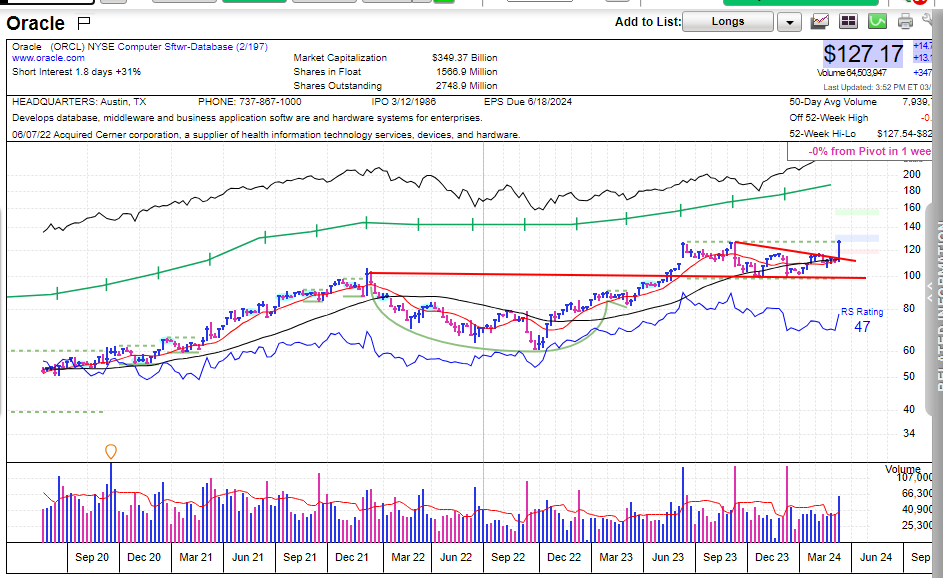

ORCL-5.27% was today's top performing SPX gainer, rising nearly 12% following a spike in bookings in their cloud computing business. CEO Safra Catz said that ORCL is "very rapidly opening new data centers to meet demand. Technically today's rise has pushed up to challenge former highs which is an important area of resistance in the short run, which formed previous highs near $127 back in June and also in September. Volume spiked to over 45 million today, the highest of the year- As weekly charts show, ORCL's stalling out from June into March represented a "base" on top of a former base. Today's huge spike signals that this consolidation is being resolved by an upside breakout and should lead ORCL higher in the weeks and months to come. Any act of consolidation of today's move should be viewed as making this quite attractive technically and lead ORCL up to 150-155 in the short run.

Mark L. Newton, CMT AC

Head of Technical Strategy

Thu, February 8, 2024 | 3:38PM ET

Another day which is more interesting than the SPX net change might indicate with prices just marginally "green" at +0.06% at 4997.37 hovering just below 5000. Both Small and mid-caps are up sharply today, while both US Treasury yields and US Dollar have pushed higher. Large-Cap Tech influence is showing a rare period of underperformancce as FTNT-1.54% , AAPL-2.41% , ORCL-5.27% , AMD-4.75% are all lower. Yet the strength of MPWR, ON, ANET, NXPI, AVGO gains are helping Semiconductor stocks and the broader equal-weighted Technology sector to show gains of more than 1%. Thus, while markets might seem flat today, Tech is actually showing some stellar outperformancel along with Equal-weighted Discretionary. Both of these RSPT-1.95% and RSPD-1.28% are up more than double what XLK-2.18% and XLY-0.98% are showing in Thursday's trading. As discussed previously, SPX 5000 has no real significance outside of psychological reasons, and likely should be surpassed next week.

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, December 12, 2023 | 11:48AM ET

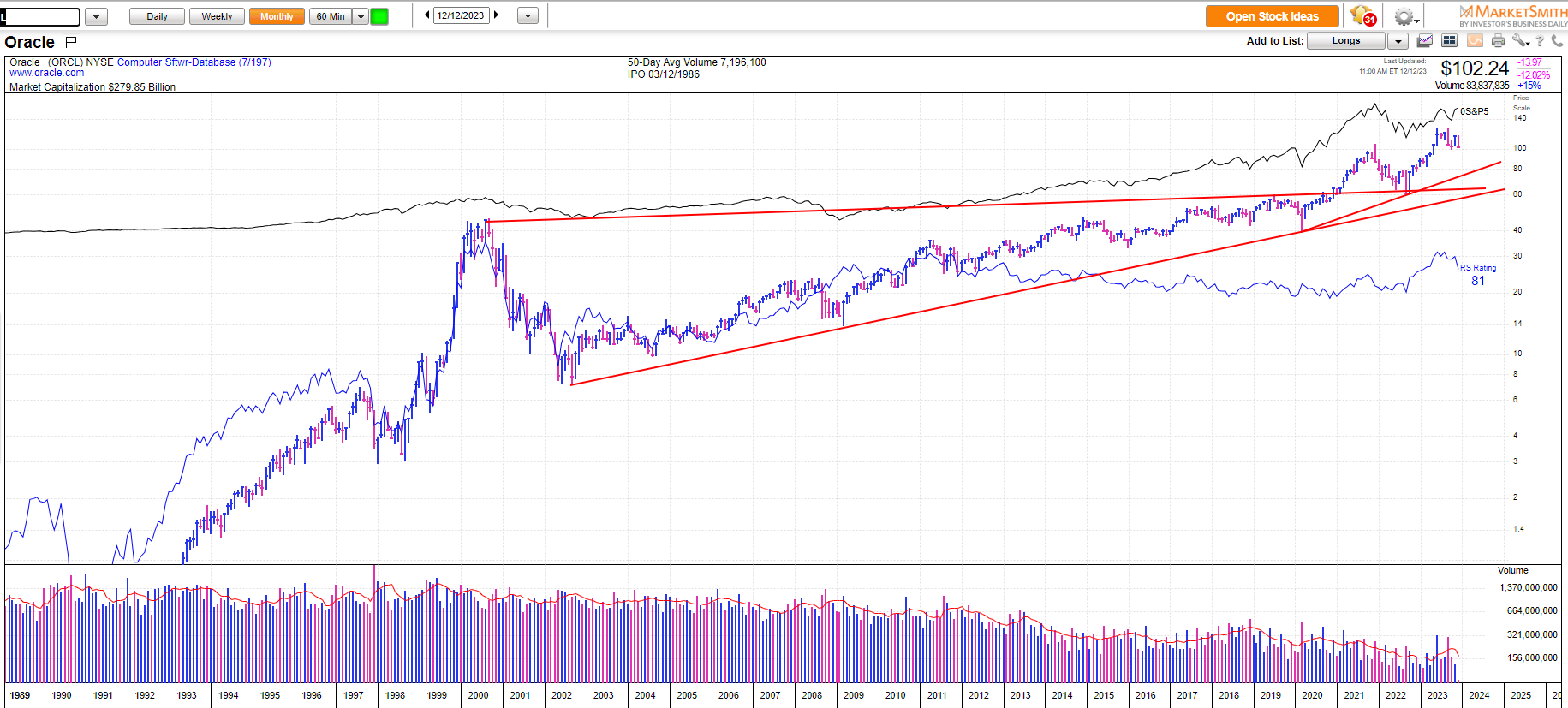

ORCL-5.27% (Part 2) Monthly pattern shows how constructive the long-term breakout into 2021 was for its pattern since it peaked back in 2000. As the technical saying goes, "the longer the base, the bigger the breakout and its potential upside" In this case, the entire 2022 bear market for US stocks saw ORCL only retrace down to test the area of the prior breakout from 2021 which is quite constructive and shows its resiliency. 2023's breakout into June happened on strong volume and it's consolidation and pullback lately hasn't done any damage to the longer-term chart. Bottom line, $99.87 is important as October 2023 lows to traders. However, intermediate-term focused investors should view ORCL as an attractive risk/reward on any decline to$85-$95, and dips to that support zone would make this even more technically attractive in 2024

Mark L. Newton, CMT AC

Head of Technical Strategy

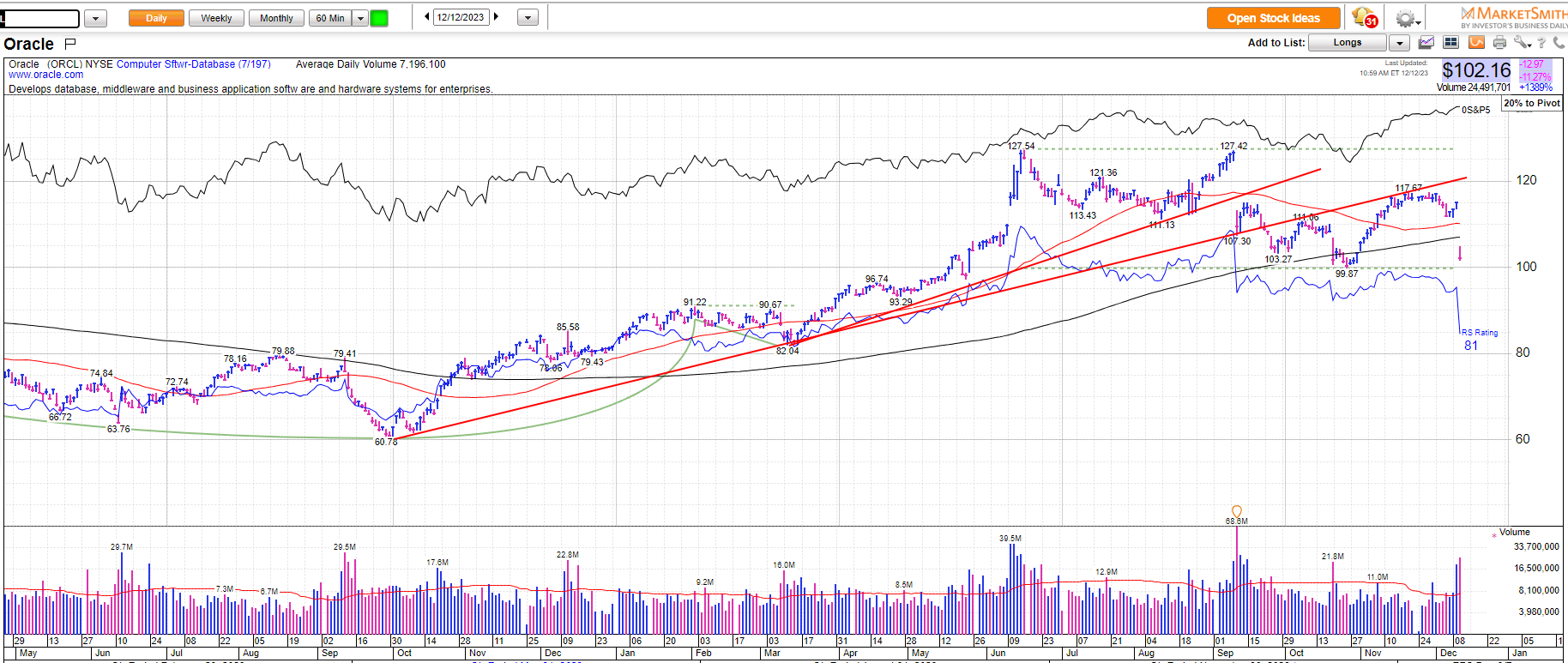

Tue, December 12, 2023 | 11:28AM ET

ORCL-5.27% (Part 1) Sales miss is disguising a larger positive message for Tech.. and driven in part by an AI chips shortage --This daily churning for most of this year isn't too problematic for its larger pattern, despite the recent trend deterioration ABC corrective patterns will line up for oppty in 2024- The area at Oct 2023 lows does have some importance, but daily patterns disguise how impressive the breakout into June proved to be for its intermediate-term pattern- I like owning this on weakness for 2024 gains

Mark L. Newton, CMT AC

Head of Technical Strategy

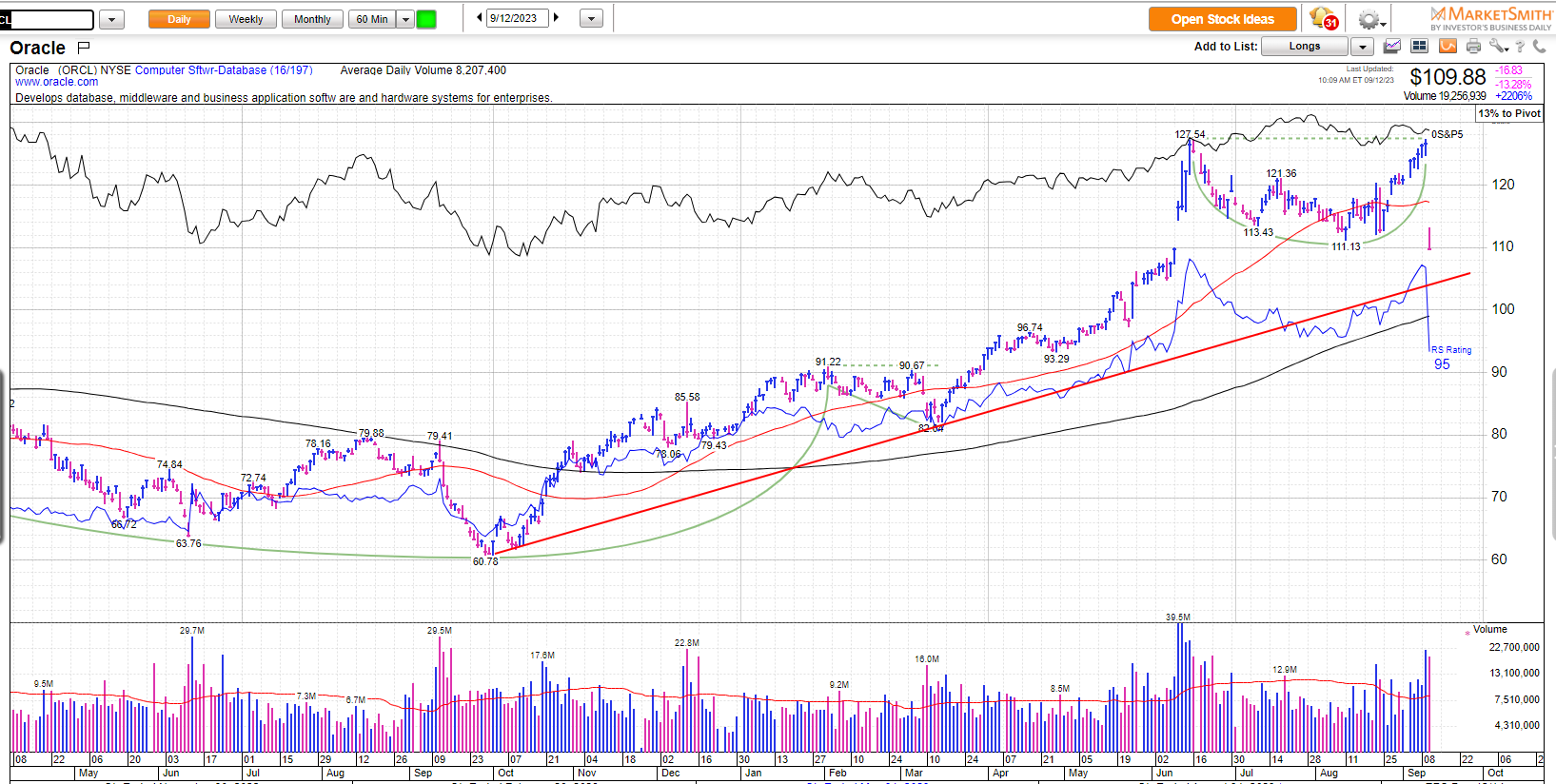

Tue, September 12, 2023 | 1:04PM ET

ORCL-5.27% Oracle's gapdown is the largest in years and occurring on very heavy volume, which has technically broken to the lowest levels since June intra-day as of 1pm EST. While$111 is a key level to hold for today, ORCL likely works lower in Sept/Oct down to 105 which represents first meaningful support on a further decline. This represents a 50% retracement of the rally from March 2023 lows. (Note that the pattern from June peaks was very much a 3-wave decline and now today's decline (Tues 9/12) also makes the former rally from mid-August also a 3-wave decline. Thus, a five wave decline is likely to complete an ABC corrective pullback, which then should be followed by a push back to new all-time highs. ) While monthly DeMark indicators show unconfirmed 13 exhaustion, there is nothing yet present on weekly charts, so i expect an initial retest of ORCL uptrend from 2022, and 105 makes sense as an initial area of support.

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19158.1

|

-1.65%

|

|

S&P 500 INDEX

|

5806.6

|

-1.50%

|

|

10Y Treasury Yield

|

4.776

|

+1.77%

|

Last updated: 2025-01-10 16:00:01