Client Portal

First Solar Inc

-

FSLR

-

$190.14

-

-0.52%

-

$190.52

-

$191.66

-

$186.97

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, July 23, 2024 | 11:48AM ET

2 hours into trading, we see S&P has just surpassed yesterday's intra-day peak (ES-1.77% _F- 5616) by S&P Futures which has helped this rally to accelerate. Breadth is just mildly positive, and Financials and REITS are the only two sectors higher today on an Equal-weighed basis, Technology is largely flat, but XLK is up +0.28%, powered higher by a near-4% bounce out of CRWD-2.87% , along with AVGO-2.15% , FSLR-0.52% , NOW-2.61% , and PANW0.20% , all which are higher by more than 2%. Software stocks are leading Semis today, and NXPI-1.35% , ON-7.24% , and TXN-0.68% are all lower by more than 3%, and SOX is lower by -0.85% at a time when XLK is outperforming. Transports are lower by 1%, but Small caps are showing stellar strength, up by 1% (IWM-2.11% ) as the SummerOfSmallCaps has arrived. Both US Dollar and Treasury yields are pulling back from earlier bounce attempts, TNX still down -0.02bps - Target initially for S&P Futures lies near 5721

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, June 11, 2024 | 11:40AM ET

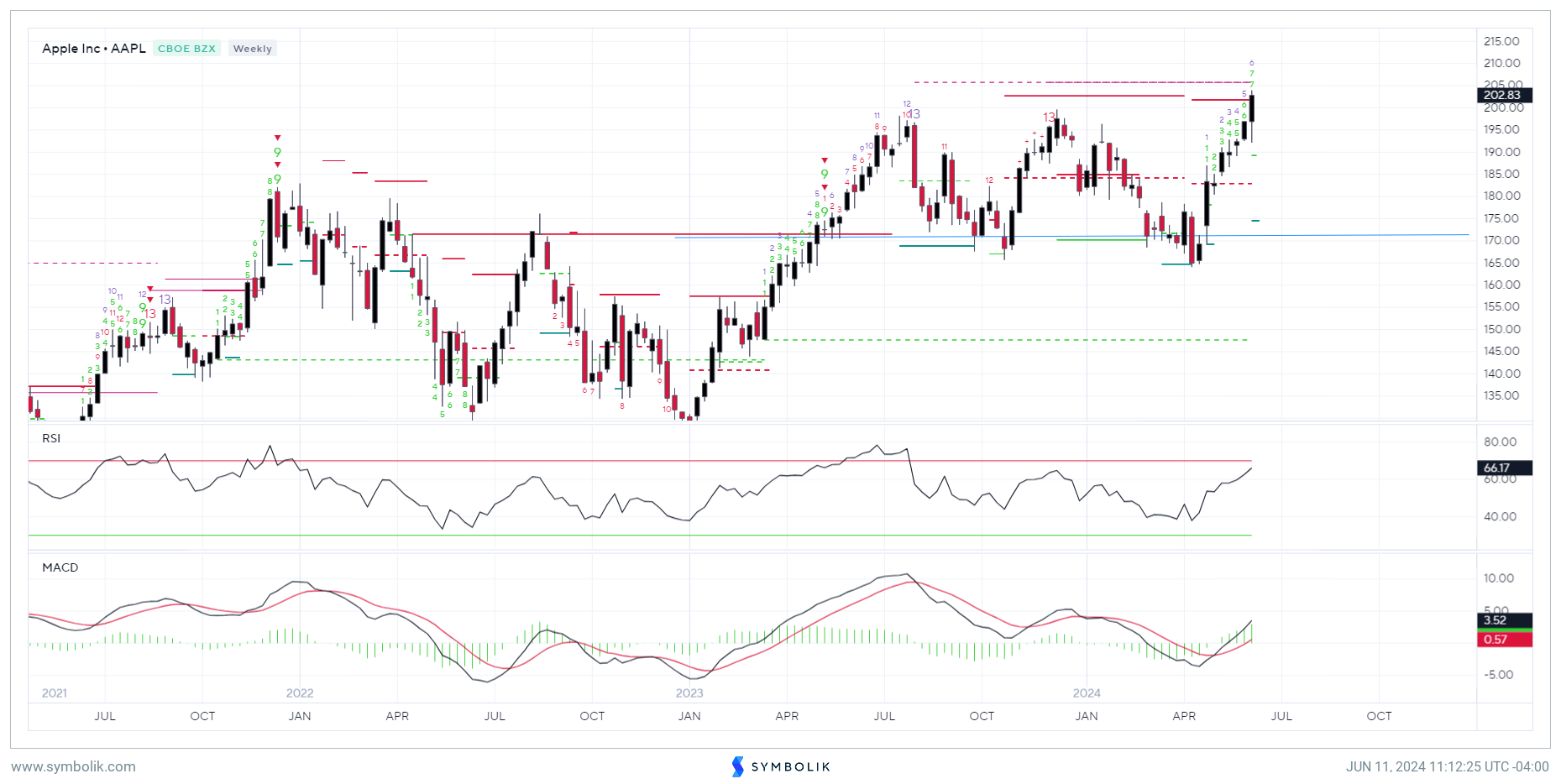

A rather unusual day for risk assets, as all 11 sectors are down on the day. yet big-cap Technology strength is helping XLK-2.26% rise by +0.85% as AAPL-2.69% breaks out above its $200 level that's held since last July. Other leading stocks within Technology include ANET-0.89% , CDNS-1.16% , NTAP-1.71% and FSLR-0.52% . Two charts of AAPL shown below, daily and weekly. While the short-term momentum is getting stretched, the counter-trend exhaustion indicators remain early to show exhaustion by around a week and a breakout back to new all-time highs for AAPL is certainly important structurally and a larger positive for SPX and QQQ given its size

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19144.1

|

-1.72%

|

|

S&P 500 INDEX

|

5799.8

|

-1.61%

|

|

10Y Treasury Yield

|

4.776

|

+1.77%

|

Last updated: 2025-01-10 15:50:01