Client Portal

Moderna

Mark L. Newton, CMT AC

Head of Technical Strategy

Thu, September 12, 2024 | 11:42AM ET

CPI and PPI data resulted in some volatility this week for Equities, but largely have locked in the outcome of next week's Fed meeting with a 25 bp cut, if the rate cut bets of the Swap market positioning is any guide. Whether or not we see a subsequent 50 bp the following meeting and Rate cuts follow the markets 200 bp into next June is open to argument, but for now, economic data has stabilized somewhat in the last month, and Treasury yields seem to be taking their cue more from labor mkt data than inflation. Equities are mildly higher today, thanks to 6 positive sectors out of 11 and breadth is around 2/1 positive. Yet, its the slightly negative move out of Technology (A-1.04% , MU-4.45% LRCX-3.37% , STX-2.28% big laggards) and Healthcare weakness (MRNA4.80% , WAT-1.57% , TMO-0.98% , PFE1.47% ) thats causing benchmark indices not to be higher.

Mark L. Newton, CMT AC

Head of Technical Strategy

Mon, March 11, 2024 | 3:17PM ET

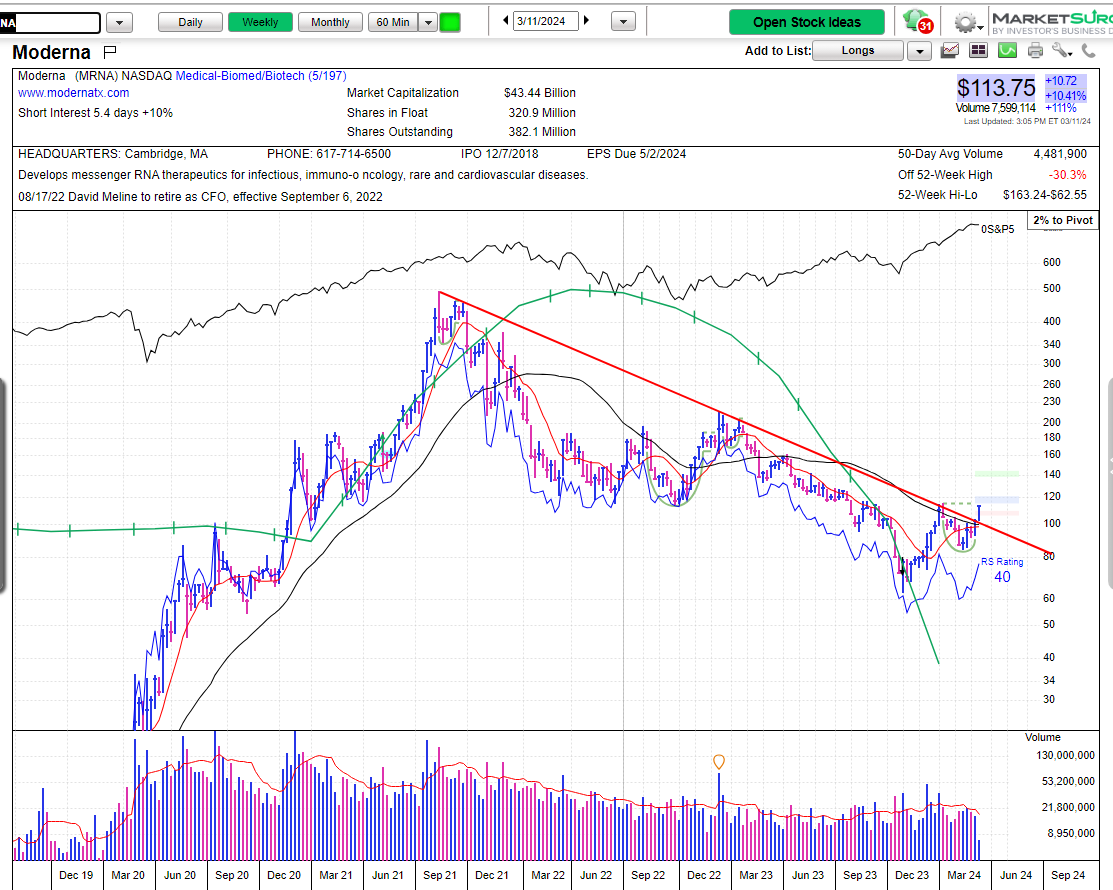

Could vaccine maker Moderna finally be on the road to recovery? MRNA4.80% is higher by +9.94% today the best performing name in the ^SPX-1.67% after the Drugmaker is starting a mid-stage study to test its experimental cancer vaccine in patients with skin cancer. This trial is in collaboration with Merck. Technically speaking, a move above $116 would allow for the lengthy downtrend to be exceeded and would also allow MRNA to recapture and surpass its January 2024 peaks, (as well as former lows from 2022) which would give a technical "green light" to the idea that further gains could happen. Upside targets above $116 on a weekly close would project to $170 initially and then $213-20

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, January 9, 2024 | 12:42PM ET

Just post Europe's close we've seen Equities start to claw back from early losses, Nasdaq has just taken out yesterday's highs while S&P is down just fractionally, as March S&P Futures have gained about 20 points from intra-day lows Yields have trended down slightly in the last 30 min and both Technology and Healthcare are positive on the day- But yet still 1%+ losses out of Energy and Materials, and 9 of 11 sectors are still down on the session. US Dollar is fractionally positive, Crude is up along with sharp gains in Natural Gas- Most metals, both precious and base metals are lower- 4764 will be important for SPX and above should allow for a quick move back up into 4793 and over- Today's leaders as of mid-day areJNPR-0.22% ,ILMN-3.09% CTLTRVTY-2.11% MTCH-2.16% while on the downside,HPE-2.76% ,ES-0.02% CAH-0.25% CHTR-0.55% andMRNA4.80% - Ability to regain yesterday's highs in SPX, DJIA and NASDAQ should be beneficial towards further gains into the close

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19524

|

-2.20%

|

|

S&P 500 INDEX

|

6001.9

|

-1.67%

|

|

10Y Treasury Yield

|

4.42

|

-1.78%

|

Last updated: 2025-02-21 16:50:01