Client Portal

Newmont

-

NEM

-

$42.70

-

-0.9%

-

$43.49

-

$43.62

-

$42.47

Mark L. Newton, CMT AC

Head of Technical Strategy

Thu, September 12, 2024 | 11:49AM ET

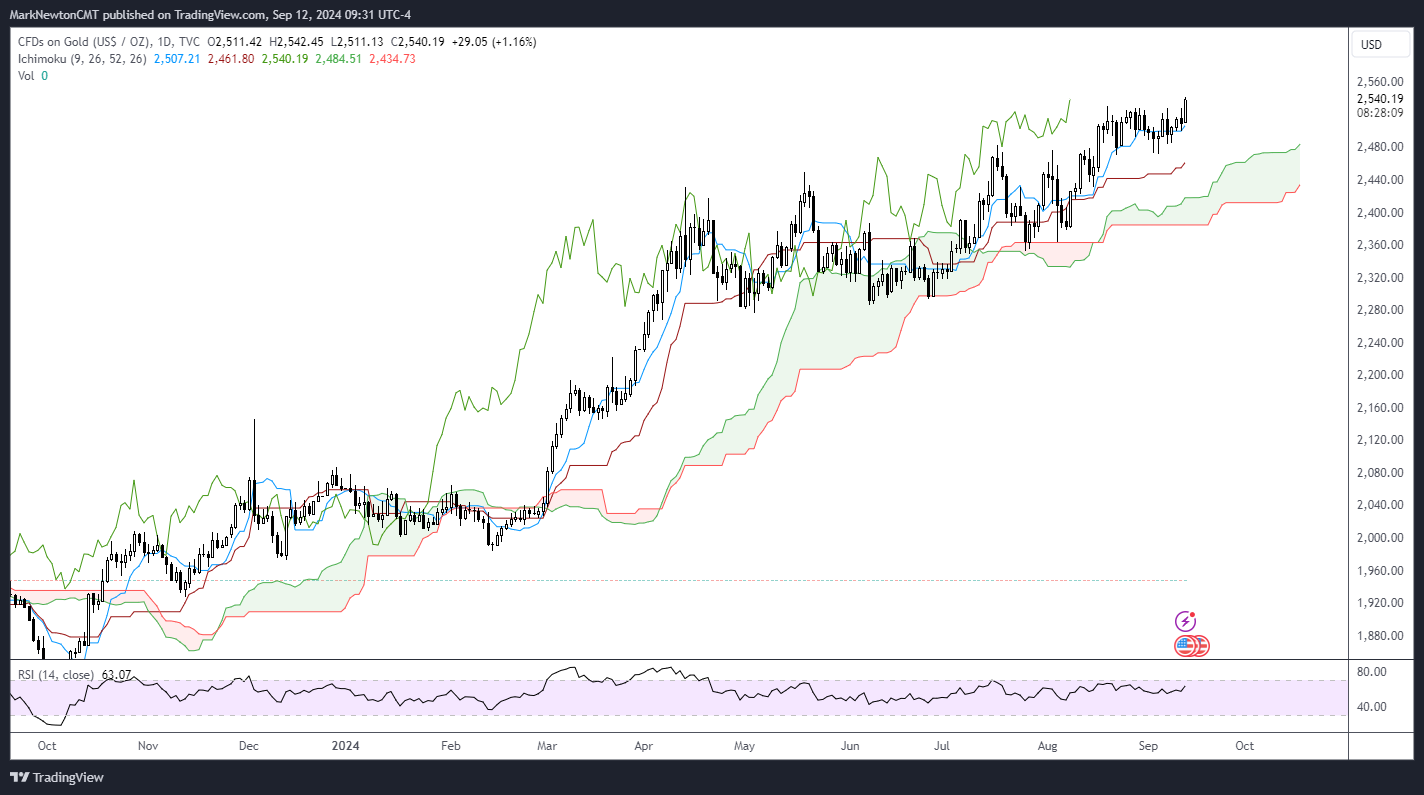

GOLD0.65% is back at new all-time highs today, thanks to Jobless Claims coming in a bit worse, while CPI, PPI were largely in-line as expected. Thus, 10-year Real yields have declined roughly 3% this week, and both Gold and Silver showing strength in today's session, along with many stocks highly correlated to Gold and Silver. (NEM-0.90% ) for example is higher by +3.88% (GC_F) Keep in mind that the last six months have produced one of the strongest runups for Gold over the last six month period since 2020. Sentiment on Gold is growing more bullish, but does not seem overly speculative yet (Daily Sentiment index (DSI) readings were 79% as of last Friday. However the fundamental reasons for Gold might certainly argue for further gains based on out-of-control US Deficits (Nearly $2 trillion annually during a non-direct war and recessionary period) and Debts. Cycle composites show Gold likely rising into October before a peak, which lines up with weekly DeMark counts on GLD (which require another 3-4 weeks of gains to produce exhaustion) I suspect that 2600-2700 is in "the cards" and it's right to expect upside continuation based on today's breakout for this month

Mark L. Newton, CMT AC

Head of Technical Strategy

Mon, November 27, 2023 | 9:57AM ET

Hope everyone had a wonderful Thanksgiving Holiday- Precious Metals providing some early morning gains this week and Gold surging to highest levels since this past Spring- As discussed in my pre-Thanksgiving report last Tuesday, this rally back to new all-time highs should be underway and both Gold and Silver are attractive for gains into year-end- Gold stocks likeNEM-0.90% andGOLD-0.73% and GDX set to close at the highest levels since early October- Given the stallout in stocks like NVDA, AAPL, GOOGL of late, precious metals might very well outperform Large-cap Tech over the next few weeks- GLD0.21% andIAU0.21% are ETF vehicles for Gold, whileSLV-0.66% is the IShares Silver ETF

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

19627.4

|

-0.28%

|

|

S&P 500 INDEX

|

6018

|

-0.54%

|

|

10Y Treasury Yield

|

4.569

|

+1.26%

|

Last updated: 2025-01-31 16:50:01