Client Portal

iShares Silver Trust

-

SLV

-

$28.01

-

-0.11%

-

$27.96

-

$28.04

-

$27.82

Mark L. Newton, CMT AC

Head of Technical Strategy

Tue, January 21, 2025 | 11:38AM ET

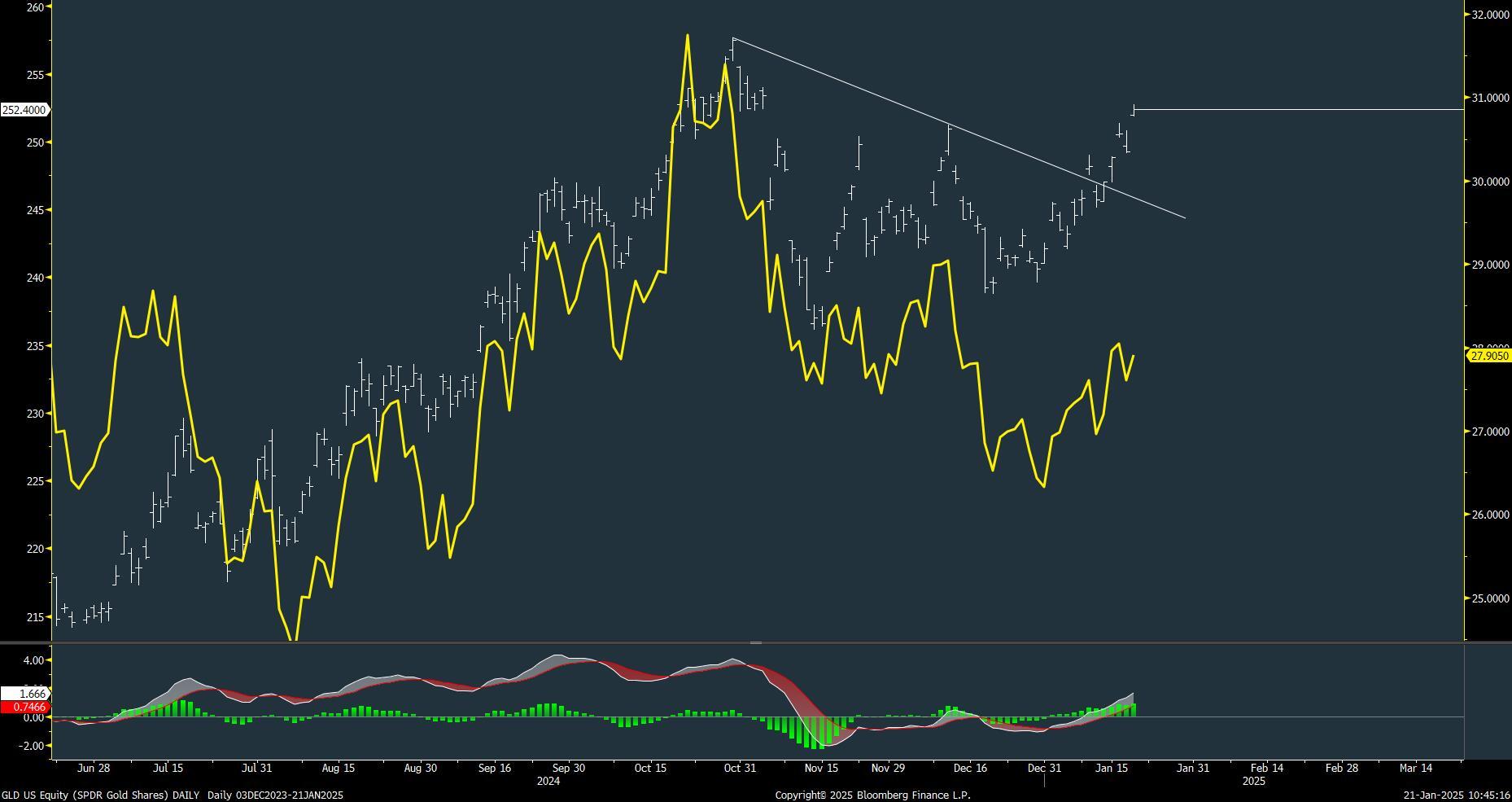

Gold and Silver have diverged lately, with Gold breaking out of its trend from last October's peaks while Silver has lagged sharply. Both might show some minor consolidation after these runups, but the patterns of both Gold and Silver should be favored for gains from February into the Summer and good likelihood of a push back to eventual new highs, above last October. Note that the pattern on the Silver chart (shown in yellow on this chart (Ishares Silver ETF SLV-0.11% ) looks almost identical to China's FXI, both which peaked out in October and have made lower highs. Overall it looks a bit premature to expect this move to continue in Gold back to new highs right away, but one should consider Gold and Silver attractive on weakness over the next couple weeks

Mark L. Newton, CMT AC

Head of Technical Strategy

Fri, September 13, 2024 | 9:47AM ET

Silver has begun to accelerate dramatically, rising from $29 to near $31 in just since yesterday's open. Silver arguably is breaking out of its downtrend today and i expect this mean reversion should allow for a push back to new high territory to join the recent move to all-time highs made by Gold this week. While stretched in the short run, the act of closing near the highs of today's range should allow for an eventual push up to test $32.75, made back in May for Front month Silver Futures. Overall, ahead of the start of next week's rate cuts, precious metals are in a sweet spot for additional gains over the next month, and both Gold and silver, along with Mining stocks are appealing (SI_F) SLV-0.11%

Mark L. Newton, CMT AC

Head of Technical Strategy

Mon, April 22, 2024 | 10:26AM ET

Big decline in the precious metals this morning, and Silver has fallen 4%. I suspect this will bring attractive opportunities for both Gold and Silver with support found near $26-$26.50. Given that Rates are closing in on cyclical peaks, this should be positive for precious metals, and now this pullback should create an appealing risk/reward for Silver likely by mid-week. As this chart shows, a move under prior lows of the prior week is certainly not a great technical development, so i expect this will lead to a bit more selling on Tuesday into Wednesday. However, following an extended period of gains and now a quick decline to multi-day lows, this appears like it should lead to opportunity for the Precious metals bulls sometime this week. SLV-0.11% and SILJ-0.74% along with GLD0.53% and IAU0.58% and Gold miners GDX0.04% should be considered attractive to own this week on a bit more weakness.

Mark L. Newton, CMT AC

Head of Technical Strategy

Mon, November 27, 2023 | 9:57AM ET

Hope everyone had a wonderful Thanksgiving Holiday- Precious Metals providing some early morning gains this week and Gold surging to highest levels since this past Spring- As discussed in my pre-Thanksgiving report last Tuesday, this rally back to new all-time highs should be underway and both Gold and Silver are attractive for gains into year-end- Gold stocks likeNEM-1.39% andGOLD-1.28% and GDX set to close at the highest levels since early October- Given the stallout in stocks like NVDA, AAPL, GOOGL of late, precious metals might very well outperform Large-cap Tech over the next few weeks- GLD0.53% andIAU0.58% are ETF vehicles for Gold, whileSLV-0.11% is the IShares Silver ETF

Contact Us

You do not have more shares available

0 out of 0/mo sharesContact Us

You do not have more shares available

0 out of 0/mo sharesEvents

Markets

|

Nasdaq Composite

|

20052

|

+1.49%

|

|

S&P 500 INDEX

|

6076.6

|

+0.76%

|

|

10Y Treasury Yield

|

4.603

|

+0.63%

|

Last updated: 2025-01-22 12:00:01